Your credit scores play a key role in your personal finances and daily life, from the interest rates you qualify for to whether you can rent an apartment or get approved for a loan. Think of a credit score like your financial grade point average: The higher your score, the better you appear to prospective creditors.

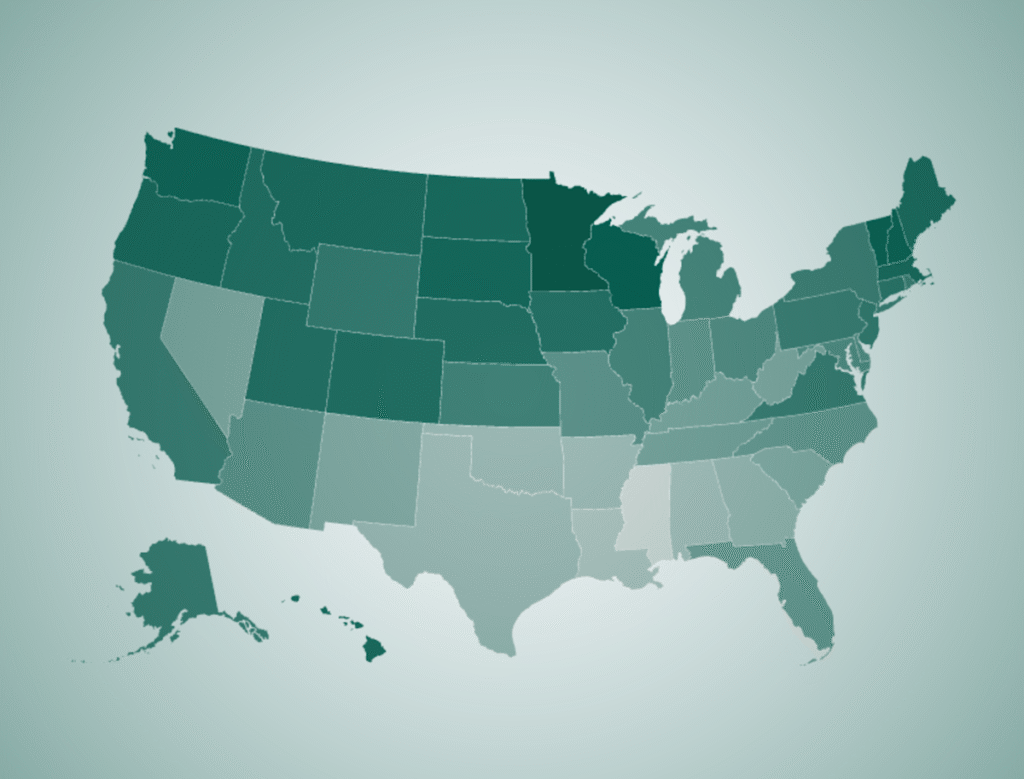

But how does your score stack up against others in your state — or across the country? Here’s a breakdown of the average credit score in every U.S. state, and what regional trends reveal about Americans’ financial health.

According to the latest analysis by Experian, the national average FICO credit score is 715 as of the third quarter of 2024. That average has remained the same since late 2023.

That’s great news for Americans, since a score within this range falls into the “good” category, which generally qualifies for favorable rates on loans, mortgages, and credit cards.

Of course, this is just an average. Several factors can impact credit scores, and average scores vary across age groups, genders, and even states.

According to Experian, the state with the lowest average credit score is Mississippi with an average FICO score of 680. Still, this falls within the lower end of the good credit score range.

The state with the highest average credit score is Minnesota with an average score of 742.

“Everyone’s financial situation is unique, which means a variety of factors can influence a person’s credit score,” said Christina Roman, consumer education and advocacy manager for Experian.

However, she noted that two of the most important factors are “payment history” and “credit utilization” (the amount of credit used compared to available limits). “Payment history is especially influential, and missing even one payment can have a quick and significant negative impact on a credit score,” Roman said.

Read more: How are credit scores calculated?

Knowing your credit score is important because it directly affects your financial opportunities and overall financial health. So if it’s been a while since you looked at your scores, take a few minutes to check in.

There are several ways to check your credit scores, many of which are free. For instance, some banks and credit card companies offer free access to your credit score within your mobile app and/or online banking dashboard.

You can also view your scores from each of the three major credit bureaus — Equifax, Experian, and TransUnion — which let you check your credit score for free and also provide optional services for a fee. Or you can sign up for a website such as Credit Karma or Credit Sesame, which offer free scores and also provide personalized insights and product recommendations to raise your score.

It’s important to note, however, that many free score providers give you access to your VantageScores, which are not used as often by lenders and likely vary from your FICO scores.

If you want to see your FICO score specifically, you can sign up for the free version of myFICO and get access to your FICO 8 score from Experian.

Read more: VantageScore vs. FICO: How these two major credit scoring models compare

It’s also important to understand that your scores may vary depending on the specific scoring model and what information has been reported to each bureau. Even so, checking one score will give you a general idea of where your credit stands.

If your credit score isn’t quite where you want it to be, there are steps you can take to move the needle in the right direction. This starts by identifying the factors that are driving your score down.

Have you missed a few payments? Consider setting up automatic payments to ensure you’re never late. Are you using too much of your available credit? Prioritize paying more than the minimum payment on your credit cards or requesting a credit limit increase to reduce the overall percentage of credit used.

“Improving your credit score is a marathon, not a sprint,” Roman said. “It takes time and consistent financial habits, but the long-term payoff is a healthier credit profile and a stronger financial footing.”

>> Sign up for Mind Your Money newsletter for weekly tips and insights