The brand new 2025 Trump tax legislation — One Huge Lovely Invoice Act — created a number of new tax deductions. Some folks say they’re above-the-line deductions, however that’s not true. These new deductions are all below-the-line. This put up explains the distinction between the several types of tax deductions.

Not a Tax Credit score

To begin with, a tax deduction shouldn’t be a tax credit score.

A tax credit score straight reduces your tax dollar-for-dollar. For those who’re imagined to pay $5,000 in tax, a $1,000 tax credit score reduces your tax to $4,000.

A tax deduction lowers your taxable revenue, which not directly reduces your tax. For those who’re imagined to pay $5,000 in tax, a $1,000 tax deduction lowers your taxable revenue by $1,000, which then reduces your tax by a fraction of it, relying in your marginal tax fee.

Subsequently, a $1,000 tax deduction is price lots lower than a $1,000 tax credit score.

Inside tax deductions, there are above-the-line deductions, commonplace deduction, itemized deductions, and a set of deductions which can be neither above-the-line nor itemized.

Above-the-Line Deductions

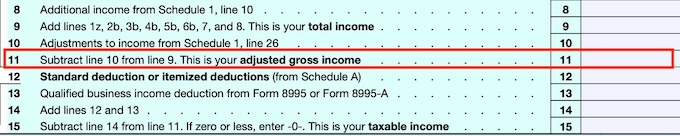

Above-the-line deductions are formally known as changes to revenue. The “line” refers back to the line on the tax kind on your Adjusted Gross Revenue (AGI). Your AGI is a key quantity that determines your eligibility for a lot of tax breaks. It’s the place to begin for Modified Adjusted Gross Revenue (MAGI) for numerous functions, as an example, youngster tax credit score, ACA medical health insurance premiums, and IRMAA.

A tax deduction is both above-the-line or below-the-line. Above-the-line deductions decrease your AGI and assist you to qualify for different tax breaks. Beneath-the-line deductions don’t have an effect on your AGI, and so they don’t assist you to qualify for different tax breaks.

Subsequently, a $1,000 above-the-line tax deduction is best than a $1,000 below-the-line deduction.

Solely particular tax deductions are designated as above-the-line. They’re listed on web page 2 of Kind 1040 Schedule 1. Listed here are some examples:

- HSA contributions made exterior of payroll

- Deductible Conventional IRA contributions

- Educator bills

- 1/2 of the self-employment tax

- Contributions to small enterprise retirement plans

- Self-employment medical health insurance deduction

Normal Deduction Or Itemized Deductions

The usual deduction and itemized deductions come after the AGI. They’re below-the-line.

The usual deduction and itemized deductions are mutually unique. For those who select to take the usual deduction, you hand over itemizing your deductions. For those who select to itemize, you forego the usual deduction.

Sometimes, you itemize solely when the sum of your itemized deductions is bigger than your commonplace deduction. You retain it easy and take the bigger commonplace deduction when you don’t have that a lot in itemized deductions.

Taking the usual deduction is a win since you’re deducting greater than your allowable itemized deductions. Over 80% of taxpayers take the usual deduction. So do I.

Itemized deductions are listed on Kind 1040 Schedule A. Mortgage curiosity, state revenue tax, property tax, and donations to charities are typical itemized deductions (aside from the brand new $1,000/$2,000 charity donations deduction whenever you don’t itemize).

Flooring and Caps

Simply because one thing is tax-deductible, it doesn’t imply you’ll be able to deduct 100% of it. It is because some deductions should first clear a ground.

For instance, medical bills are tax-deductible, however you’ll be able to solely deduct the portion that exceeds 7.5% of your AGI. That involves zero for many individuals.

Some deductions have a cap. You possibly can deduct solely as much as the cap, even if you happen to paid extra. State and native taxes (SALT) are a widely known instance of this.

The brand new 2025 Trump tax legislation elevated the SALT cap. Extra persons are anticipated to itemize deductions, however they’re nonetheless a minority. Over 80% of individuals will nonetheless take the usual deduction.

Beneath-the-Line, Obtainable-to-All

Within the outdated days, particular person tax deductions had been both above-the-line or itemized deductions. Solely above-the-line deductions had been accessible to everybody. Beneath-the-line deductions had been solely the usual deduction or itemized deductions. After taking the above-the-line deductions, you would solely take the usual deduction if you happen to don’t itemize.

This dichotomy between above-the-line and must-itemize not holds. Congress has created a number of deductions lately which can be below-the-line however don’t require itemizing. You possibly can nonetheless take these deductions whenever you take the usual deduction, however they don’t have an effect on your AGI. A deduction accessible to everybody doesn’t essentially imply it’s above-the-line.

| Itemize | Don’t Itemize | |

|---|---|---|

| Above-the-Line Deductions | ✅ | ✅ |

| Normal Deduction | 🚫 | ✅ |

| Itemized Deductions | ✅ | 🚫 |

| Beneath-the-Line, Obtainable-to-All | ✅ (except particularly excluded) | ✅ |

Each above-the-line deductions and this new set of deductions can be found to everybody (except it’s particularly excluded). The distinction is in whether or not it impacts your AGI. Solely the usual deduction and itemized deductions are nonetheless either-or.

Congress created these below-the-line, available-to-all deductions as a result of they wished to make them accessible to extra folks. Giving them to solely those that itemize deductions (10-20% of taxpayers) can be too limiting. However Congress didn’t need these deductions to decrease the AGI and set off different tax breaks. A few of these deductions themselves have limits primarily based on the AGI. Making them above-the-line would create a round math downside.

Listed here are a few of the below-the-line available-to-all deductions:

All of those deductions are nonetheless accessible if you happen to take the usual deduction, however they don’t decrease your AGI.

Say No To Administration Charges

If you’re paying an advisor a share of your property, you might be paying 5-10x an excessive amount of. Learn to discover an impartial advisor, pay for recommendation, and solely the recommendation.