For a lot of, the concept of retiring at age 50 sounds superb. Nonetheless, many query whether it is even sensible. Contemplating that anybody born after 1960 gained’t qualify for full Social Safety advantages till age 67, that leaves 17 years earlier than they may entry that supply of earnings in the event that they cease working at age 50. Plus, most retirement accounts – like 401(ok) and IRA accounts – gained’t mean you can make withdrawals with out penalties till age 59 ½, leaving an 8 ½-year hole. However, even with that, that doesn’t imply retiring at age 50 isn’t attainable. In truth, listed below are 4 simples issues you are able to do put your self heading in the right direction.

How you can Retire at Age 50

In case your aim is to retire at age 50, you’ll want to begin planning instantly. In the event you don’t plan on working when you retire, you must have sufficient saved to cowl the remainder of your life.

With the typical U.S. life expectancy now averaging 78.4 years (per the CDC), plan for 28+ years of bills—probably 35+ in case you’re wholesome and lively. So that you’ll must plan for having sufficient cash to assist your self (and presumably your family, for 28 years or longer.

The 28 to 35 years is an effective rule of thumb. Nonetheless, if you wish to know what number of years you particularly have left, the Social Safety Administration has a helpful calculator right here.

As daunting as which will appear, saving for 28 to 36 years of bills is doable. It simply requires some planning, diligence, and dedication. Right here’s get began.

1. Save as A lot as Doable

Retiring early requires a considerable quantity of financial savings. Together with having a sturdy retirement account, providing you with one thing you possibly can faucet when you attain age 59 ½, you’ll want one other supply of funds to cowl that 8 ½-year hole.

Many who intention to retire at age 50 open funding accounts past their retirement financial savings autos. Usually, these accrue extra in curiosity than conventional financial savings accounts, permitting your cash to develop extra rapidly. Nonetheless, they aren’t risk-free, so it’s good to contemplate your danger tolerance and select choices which are best for you. For instance, investing in index funds, target-date funds, and lots of mutual funds present a degree of diversification, so they could be place to begin if you’re new to investing.

2. Scale back Your Bills & Increase Your Revenue

The much less it’s good to spend every month, the much less you’ll want to avoid wasting. Sort out as a lot debt as attainable earlier than you attain age 50, and the aim turns into extra sensible. Equally, contemplate slicing again on pointless providers, like premium cable packages, or different high-dollar bills, like eating out, to make retiring early extra manageable.

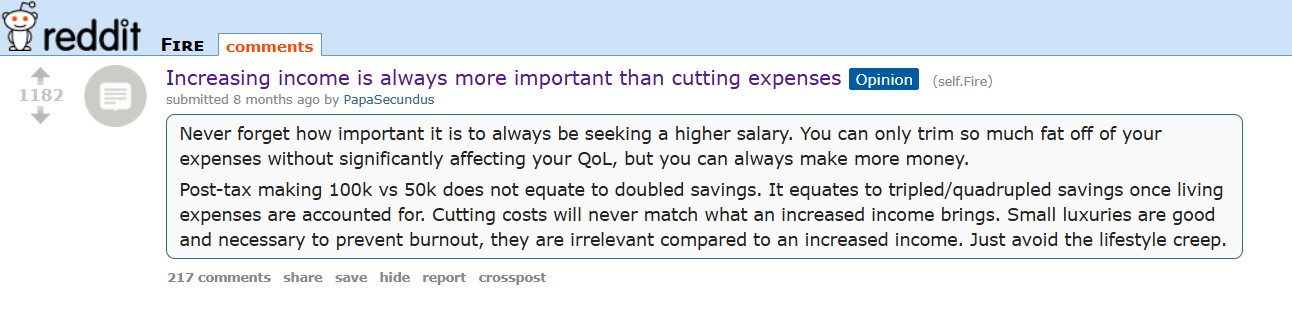

Take into account boosting your earnings as properly. Getting a second job, beginning a aspect enterprise or negotiating together with your job for a increase are all good concepts for realistically supplementing your earnings. In truth some commentators be aware that aspiring retirees can solely save a lot, whereas bettering ones earnings theoretically has no higher restrict. Reddit person PapaSecundus mentions this:

3. Calculate Your Publish-Retirement Spending

As a way to decide how a lot you’ll need to avoid wasting, it’s good to perceive what you’ll spend in retirement. This consists of every little thing from debt funds to family bills to medical prices. Plus, it’s good to account for any modifications to your entertainment-oriented bills. If you retire, you might wish to journey, see extra films on the theater, or embrace a passion, all of which may influence your spending estimates.

You’ll additionally must take care of inflation, one thing that may considerably influence your spending energy over time. Inflation has averaged 2.8% % per yr. Which means that in case you want $50,000 per yr proper now, you may want $66,000 in ten years. The Bureau of Labot Statistics has a helpful inflation calculator right here.

Planning for healthcare prices will be particularly difficult. You gained’t have entry to Medicare till you might be eligible for Social Safety advantages. Even when your worker has post-retirement medical choices out there, the premiums are often increased than they might be if you’re nonetheless working, so it’s good to discover your choices totally to estimate the price.

When you calculate your spending, you should use that info to extrapolate how a lot it’s good to save. Normally, planning to make use of a withdrawal price of two to 4 % is a great transfer. If you wish to be conservative and use the two % price and estimate you’ll want $50,000 a yr, you then’d have to avoid wasting $2.5 million earlier than you attain age 50 if that’s whenever you wish to retire.

4. Take into account a Partial Retirement

In the event you can’t save sufficient to completely retire at age 50, that doesn’t imply you possibly can’t dramatically change your relationship with the working world by then. For instance, you could possibly save sufficient to cowl a part of your bills after which choose to work at a job you get pleasure from on a part-time foundation till Social Safety kicks in or you possibly can entry different retirement financial savings. Not solely will this offer you some flexibility and extra earnings, but it surely additionally provides you extra time to decrease your bills and save.

Then, whenever you attain age 59 1/2, 67, or something in between, you possibly can reassess and shift to a full retirement whether it is viable. That approach, you possibly can change your life-style earlier, making your years really feel extra fulfilling and rewarding.

At what age do you suppose you’ll retire? Does 50 sound sensible and even attainable for you? Share your ideas within the feedback beneath.

You May Additionally Get pleasure from….

Tamila McDonald is a U.S. Military veteran with 20 years of service, together with 5 years as a navy monetary advisor. After retiring from the Military, she spent eight years as an AFCPE-certified private monetary advisor for wounded warriors and their households. Now she writes about private finance and advantages applications for quite a few monetary web sites.