The market was expecting great results and guidance from Nvidia after the Wednesday market close, and the company delivered once again, announcing that its first quarter revenues rose 69.6% to $44.1 billion, compared with $26 billion in the first quarter of 2024. During the same period, Nvidia’s operating earnings rose 57.4% to 96 cents per share compared with 61 cents last year. The analyst community was expecting revenue of $43.3 billion and operating earnings of 93 cents per share, so the company posted a 1.8% sales surprise and a 3.2% earnings surprise – despite the fact that Nvidia had to write down $8 billion in first quarter revenues, due to the Trump Administration’s export ban on AI chips to China.

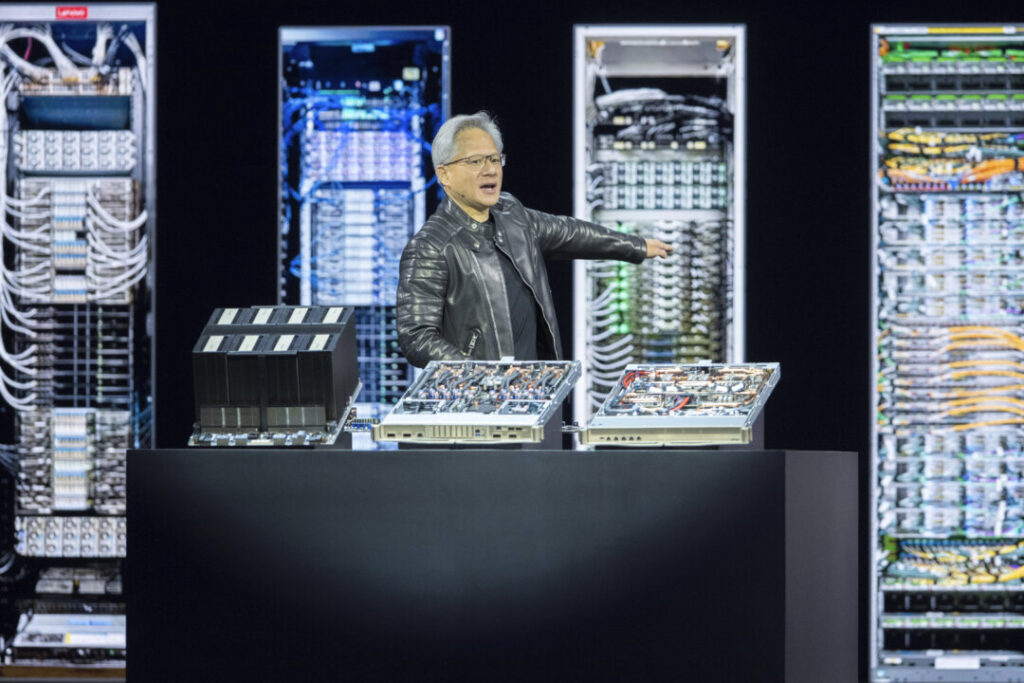

Nvidia CEO and founder Jensen Huang is now the head cheerleader for AI as well as quantum computing, since Nvidia recently held a quantum computing architecture contest, which D-Wave (QBTS) won. Huang continues to paint a positive picture of how he expects AI to continue to unfold and literally envelop more aspects of our lives. One observation that I have made is that younger people are clearly obsessed with AI for its superior internet search and advice. Fortunately, after talking to CNBC’s Jim Cramer and Bloomberg, Huang continued to inspire investors and AI users with his upbeat guidance.

Here are the most important market news items and what this news means:

– The bears on Wall Street keep recycling old ideas to distract investors and are pathetic party poopers. The main bearish argument is that the “big beautiful” tax bill will cause the federal budget deficit to soar and cause interest rates to rise. Let me explain what happens when there is a tax cut. When the federal government puts more money in your pocket, consumers typically put that money in the bank, and then banks buy more Treasury securities, so tax cuts do not cause Treasury yields to rise. Furthermore, when the velocity of money perks up, prosperity rises, and often tax revenue rises. So, the key to economic prosperity is to set tax rates so that the velocity of money rises.

– I remain optimistic that the tariff confusion will dissipate in the upcoming months. Furthermore, I expect inflation will remain low due to (1) lower crude oil prices, (2) deflation from China, and (3) excess inventories from the dumping of goods in the first quarter. Resurging consumer confidence and rising personal income are a powerful “one-two” punch that will sustain strong economic growth. The new “big beautiful” tax bill will also put more money in consumer pockets, plus impending Fed key interest rate cuts will also boost consumer confidence and spending.

– Dwindling U.S. exports are hindering the ISM manufacturing index. The Institute of Supply Management (ISM) announced that its manufacturing index declined to 48.5 in May, down from 48.7 in April. This represents the third consecutive month that the ISM manufacturing index has been below 50, which signals a contraction. The production component rose to 45.4 in May, up from 44 in April, while the new orders component improved to 47.6 in May, up from 47.2 in April. Despite these green shoots, the new export orders component plunged to 40.1 in May, down from 43.1 in April, while the imports component plunged to 39.9 in May, down from 47.1 in April. Only 3 of the 15 manufacturing industries surveyed reported an expansion in May, so the manufacturing sector continues to struggle.

– China’s Caixin manufacturing purchasing managers index plunged to 48.3 in May, down from 50.4 in April. This index is called the Private Factory Gauge and is not manipulated by the Chinese government. Since any reading below 50 signals a contraction, it is obvious that the higher tariffs against China are taking a toll. It is also being widely reported that the tariff negotiations with China are hitting an impasse, so a call between President Xi and President Trump may be imminent. The Wall Street Journal reported that China’s lead trade negotiator, Vice Premier He Lifeng, is playing hardball and not cooperating with the Trump Administration. In the meantime, the Factory Gauge is now at its lowest level since 2022 and is expected to remain weak until there is a trade negotiation breakthrough.

– The European Central Bank (ECB) was provided with further evidence why it should cut key interest rates for the eighth time on Thursday. Specifically, inflation in the eurozone decelerated to a 1.9% annual pace in May, down from a 2.2% annual pace. A dramatic drop in May service inflation to a 3.2% annual pace (down from a 4% annual pace in April) to the lowest level since March 2022 helped to reduce inflation in the eurozone. The primary reason that eurozone inflation is running lower than the U.S., with a 2.2% annual pace based on the PCE (personal consumption expenditures) index, is that the eurozone does not have housing inflation, since its households are shrinking due to an aging population.

– New German Chancellor Friedrich Merz implied that the EU could retaliate against U.S. technology companies if the trade conflict with the Trump Administration escalates. Specifically, Merz said he aims to reduce tariffs and defuse tensions with the White House. Merz said, “At the moment, we strongly protect U.S. tech companies,” and added, “That can be changed, but I don’t want to escalate this conflict. I want to solve it together.” Clearly, Chancellor Merz does not want to fight with President Trump, since Germany has very few ways to retaliate.

– Interestingly, Germany recently dispatched its Economy Minister, Katherina Reiche, to Brussels to plead with the European Commission to approve a plan to support energy-intensive industries, such as cement, glass, steel and chemicals. Reiche said, “Not having steel production in Germany would mean entering into new dependencies,” and added that “To no longer have basic chemical production would mean entering into new dependencies.” Germany is seeking to approve a reduced electricity rate for energy-intensive industries via an EU subsidy, since its Net Zero mandate is systematically causing electricity prices to soar and destroy Germany’s industrial base. Obviously, if Germany gets an EU electricity subsidy, other EU members will also seek similar subsidies. As a result, the eventual implosion of the EU is getting closer as Brussels’ oppressive regulations destroy German industries.

– The Ukrainian drone attack on approximately 40 Russian military planes (including most of Russia’s bomber fleet) deep inside Russia is incredibly embarrassing for Vladimir Putin. The whole world is now very nervous about how Putin may respond, since this was a major escalation and expanded the battlefield. In the meantime, gold is doing well amidst all the uncertainty.

Overall, I hope you see why the U.S. is an economic oasis around the world. Not only is the U.S. food and energy independent, but we do not have an oppressive bureaucracy, like the EU in Brussels, systematically destroying farming and manufacturing with their oppressive policies. The Trump Administration is inherently pro-business. In fact, the Atlanta Fed’s GDP Now is forecasting 4.6% annual GDP growth for the second quarter, which is tremendous.

Disclosures: Navellier & Associates owns Nvidia Corp (NVDA), and D-Wave Quantum Inc. (QBTS), in managed accounts. Louis Navellier and his family own Nvidia Corp (NVDA), and D-Wave Quantum Inc. (QBTS), via a Navellier managed account, and Nvidia Corp (NVDA), in a personal account.

*Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times.