Navigating gross sales tax compliance isn’t getting any less complicated.

Between shifting nexus legal guidelines, jurisdictional fee adjustments, and increasing cross-border guidelines, even seasoned finance groups can really feel buried below filings and reconciliations. Based on current market knowledge, the worldwide gross sales tax software program market is valued at USD 11.04 billion in 2025 and is projected to almost double to USD 20.46 billion by 2034, a transparent signal of how crucial automation has change into in conserving companies compliant and audit-ready.

To grasp what separates a median answer from a very dependable one, I evaluated over 15 instruments to seek out the finest gross sales tax compliance software program utilizing G2 assessment knowledge, specializing in automation depth, integration protection, submitting effectivity, and multi-jurisdiction accuracy. What stood out most had been platforms that didn’t simply calculate tax, however made reporting and remittance seamless throughout states and nations.

Listed below are the six that delivered the very best stability of accuracy, usability, and peace of thoughts for rising income groups.

6 finest gross sales tax compliance software program for 2025

- Avalara: Finest for automated tax calculation and submitting at scale

Ultimate for managing multi-state and worldwide tax obligations, with automated fee updates, return submitting, and broad ERP and e-commerce integrations. - Vertex: Finest for enterprise-grade oblique tax administration

For complicated tax environments, providing superior tax dedication, knowledge validation, and integrations with SAP, Oracle, and different enterprise programs. - Anrok: Finest for SaaS corporations managing recurring income compliance

Constructed for subscription billing, Anrok automates nexus monitoring, tax calculation, and submitting throughout international jurisdictions for software program and digital merchandise. - DualEntry: Finest for real-time transaction-level tax accuracy

Presents a developer-friendly API that automates tax calculation instantly inside accounting and fee workflows, making certain clear, audit-ready knowledge. - TaxJar: Finest for small to mid-sized e-commerce tax automation

Simplifies gross sales tax submitting and nexus monitoring for on-line sellers, with integrations for Shopify, Amazon, and WooCommerce. - Paddle: Finest for international tax compliance in digital product gross sales

Handles worldwide VAT, GST, and gross sales tax on behalf of sellers, making it supreme for SaaS and digital platforms increasing globally.

*These gross sales tax and VAT compliance software program are top-rated of their class, based on G2’s Fall 2025 Grid Report. I’ve added their standout options to make comparisons simpler for you. For pricing particulars, please contact the gross sales staff instantly by way of their official web site.

What makes a gross sales tax compliance software program price it?

Fashionable income groups aren’t struggling as a result of they’ll’t calculate tax — they’re struggling as a result of tax by no means stops altering. New jurisdictions pop up, product taxability shifts in a single day, and handbook filings can’t preserve tempo with the velocity of digital enterprise. One missed replace can snowball into penalties, delayed remittance, or messy reconciliations that drain whole quarters.

That’s why gross sales tax compliance software program has change into vital in finance stacks. These platforms flip unpredictable tax guidelines into predictable workflows, dealing with calculations, filings, and exemptions routinely whereas conserving tempo with regulatory change. As an alternative of reacting to errors, groups can audit confidently, plan proactively, and scale into new markets with out tax changing into a bottleneck.

Briefly, the worth isn’t simply in automation; it’s in assurance. The suitable software program provides finance and tax groups management, visibility, and accuracy at each stage of the compliance course of.

How did I discover and consider the very best gross sales tax software program?

I began with G2’s Grid Report, narrowing all the way down to instruments that constantly earned excessive satisfaction scores and powerful adoption throughout finance and operations groups. That helped me determine a mixture of established leaders in addition to fast-rising challengers.

From there, I analyzed a whole bunch of verified G2 opinions utilizing AI-assisted sample recognition to grasp what customers truly worth in each day use. The most important constructive themes centered on automation accuracy, multi-jurisdiction submitting, integration reliability, and the flexibility to remain compliant as corporations increase globally. On the identical time, reviewers surfaced frequent friction factors round implementation complexity, customization limits, and reporting element.

To validate these insights, I linked with finance professionals who handle tax compliance throughout a number of programs. Their suggestions helped me distinguish instruments that carry out properly in demos from people who stand as much as real-world submitting cycles and audits.

Every platform on this listing earned its place by a mix of G2 Knowledge, verified buyer sentiment, and hands-on analysis.

All product screenshots featured on this article come from official vendor G2 pages and publicly obtainable supplies.

What I prioritized when evaluating the very best gross sales tax compliance software program

I thought-about the next elements when evaluating the gross sales tax compliance software program and choosing the right software program for VAT compliance, based on G2 opinions.

- Actual-time tax calculation and accuracy: I centered on platforms that ship up-to-date charges and product taxability guidelines throughout jurisdictions. Instruments that validate transactions immediately assist stop pricey submitting errors and missed updates. Actual-time accuracy ensures finance groups can belief their numbers, even when tax legal guidelines change unexpectedly.

- Automated submitting and remittance workflows: Submitting returns manually can drain hours from finance groups every month. I prioritized instruments that automate filings end-to-end from return technology to remittance scheduling, whereas permitting assessment and approval earlier than submission. This stability of automation and management helps groups save time with out shedding oversight.

- Nexus monitoring and jurisdiction monitoring: As companies increase, realizing the place they owe tax turns into a transferring goal. The very best instruments routinely monitor thresholds by state or nation, alerting customers as they method new nexus triggers. Platforms with visible dashboards and threshold summaries provide a transparent benefit for proactive compliance administration.

- Integration protection throughout ERP, billing, and e-commerce programs: Seamless knowledge stream is crucial for accuracy. I prioritized instruments that combine natively with frequent enterprise instruments, making certain tax knowledge stays constant throughout programs. Robust integration help reduces reconciliation work and improves end-to-end visibility.

- Exemption certificates and doc administration: Lacking or outdated exemption certificates are a typical audit danger. I favored instruments that retailer all certificates in a single place, automate renewal alerts, and fix paperwork on to transactions. This centralized method simplifies audits and helps keep compliance with out handbook monitoring.

- World VAT and cross-border compliance: For corporations promoting internationally, VAT and GST compliance can get complicated quick. I regarded for options that help totally different frameworks, deal with multi-currency invoicing, and generate region-specific stories. Platforms with worldwide capabilities scale back friction for increasing digital companies.

- Reporting, analytics, and audit readiness: Clear reporting separates sturdy compliance software program from primary automation instruments. I valued platforms providing customizable dashboards, detailed audit logs, and reconciliation summaries. These options make it simpler for groups to confirm filings and keep full audit trails.

- Scalability and ease of implementation: Even superior tax instruments lose worth in the event that they’re tough to deploy or keep. I prioritized software program with easy setup processes, sturdy onboarding help, and scalability from SMBs to enterprises. Instruments that stability sophistication with usability are finest positioned to develop with the enterprise.

The listing under comprises real consumer opinions from the Gross sales Tax and VAT Compliance Software program Class web page. To be included on this class, an answer should:

- Monitor gross sales tax, VAT, GST, or different charges and guidelines for all jurisdictions related to a consumer’s services or products

- Monitor and apply tax exemptions for the suitable occasions, merchandise, transactions, or accounts

- Robotically replace charges and guidelines in response to coverage revisions or new laws

- Combine with accounting and transaction instruments in order that right charges are communicated, saved, and utilized the place crucial

- Automate and handle returns and remittance for all jurisdictions

*This knowledge was pulled from G2 in 2025. Some opinions could have been edited for readability.

1. Avalara: Finest for automated tax calculation and submitting at scale

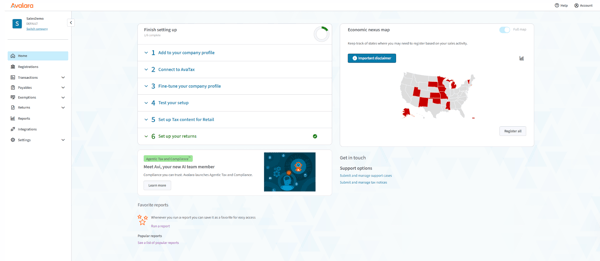

Avalara is among the most established gamers within the gross sales tax compliance software program market, recognized for its accuracy and depth throughout complicated jurisdictions. Based on G2 Knowledge, 39% of its customers are small companies and 49% are mid-market groups, notably within the retail, laptop software program, and accounting industries. Its large adoption displays how successfully it balances automation energy with usability, serving to corporations handle tax calculation, submitting, and exemption monitoring from one linked platform.

Automated tax calculation is the muse of Avalara’s worth. The system repeatedly updates its tax content material database with new state, county, and metropolis charges, making certain real-time accuracy for each transaction. Customers appreciated how the automation eliminates handbook lookups and errors. Avalara additionally helps granular product taxability guidelines, which assist groups appropriately apply exemptions, bundles, or category-specific charges with out fixed oversight.

Its returns submitting earned equally sturdy suggestions. The platform prepares, recordsdata, and remits returns throughout hundreds of jurisdictions. Customers famous that with the ability to assessment filings earlier than submission provides them confidence with out including handbook workload. For finance groups dealing with a number of entities or frequent submitting cycles, this function considerably reduces time spent reconciling returns.

The instrument’s nexus monitoring functionality stood out as a core benefit. It routinely displays the place a enterprise is nearing or exceeding nexus thresholds and visualizes these triggers in an intuitive dashboard. This makes it simple for compliance groups to behave proactively. Companies increasing into new states or nations discovered this particularly helpful for sustaining steady compliance.

Integrations are one other space the place Avalara shines. The platform connects seamlessly with NetSuite, Shopify, QuickBooks, Salesforce, and a whole bunch of different programs. These connections permit tax knowledge to stream routinely between billing, ERP, and e-commerce environments, minimizing reconciliation work and handbook imports. Reviewers regularly famous that this interoperability enhanced total knowledge accuracy and audit readiness.

Avalara’s exemption certificates administration function additional simplifies compliance. It shops certificates in a centralized repository, routinely validates them, and hyperlinks each to its respective buyer or transaction. This prevents lacking or expired certificates from slipping by throughout audits.

The dashboard and consumer interface add to the instrument’s usability. Regardless of its highly effective automation, customers described the interface as approachable, with clear navigation and steering by every step. The primary dashboard consolidates submitting progress, remittance standing, and nexus exercise, giving groups an prompt view of their compliance posture.

Avalara’s buyer help gives detailed steering and technical experience, notably for complicated filings and multi-jurisdiction setups. Some customers famous that in peak submitting intervals, response occasions can differ as help groups prioritize high-volume circumstances. For organizations that favor fast help, this will sometimes lengthen decision timelines. This helps keep service high quality and effectivity when demand is at its highest.

The platform’s reporting instruments and databases are strong, however some customers discover the net interface slower when processing giant knowledge units or producing detailed stories. This delay displays Avalara’s intensive tax engine, which manages hundreds of dwell fee updates. For many groups, these delays are acceptable given the system’s accuracy and completeness.

Total, Avalara combines intensive jurisdiction protection, highly effective automation, and large integration help, making it probably the most reliable choices for companies that have to handle complicated tax compliance effectively.

What I like about Avalara:

- G2 reviewers praised Avalara for its dependable automation and huge tax fee protection throughout jurisdictions.

- Many appreciated how seamlessly it integrates with in style ERP and e-commerce platforms, decreasing handbook reconciliation work. The system’s real-time accuracy provides finance groups confidence that filings and remittances are dealt with appropriately each time.

What G2 customers like about Avalara:

“I’m a repeat Avalara buyer, having put in the suite at 5 separate corporations. We love the “one-stop store” answer to unify our wants for gross sales and use tax, managed companies, certificates administration, 1099 filings, tax filings, and on and on. It’s the gold customary in tax options. Moreover, I search for companions with an incredible staff and a straightforward rapport, and Avalara delivers. Even when now we have skilled any struggles, folks have been on the prepared to assist.”

– Avalara assessment, Kelly S.

What I dislike about Avalara:

- Some G2 customers talked about that buyer help can take longer to reply throughout high-volume submitting seasons.

- Just a few G2 reviewers famous that the net interface could really feel slower when producing giant or complicated stories. Nonetheless, most agreed that the platform’s depth and accuracy outweigh these minor trade-offs.

What G2 customers dislike about Avalara:

“The setup generally is a bit boggy, however with the fitting help, it is navigable. And the help tickets generally is a bit fast to shut and not using a full rationalization of what truly occurred and whether or not or not it was resolved vs. closed.”

– Avalara assessment, Jennie A.

Associated: Seeking to simplify shopper invoicing and compliance in your authorized staff. Discover our information to the finest authorized billing software program for correct, automated time and expense monitoring.

2. Vertex: Finest for enterprise-grade oblique tax administration

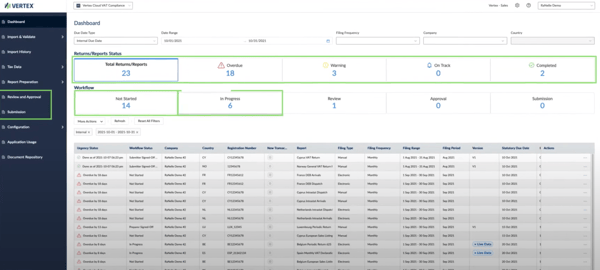

Vertex is trusted by enterprises for its precision and scalability. Based on G2 Knowledge, 55% of its customers are enterprises and 28% are mid-market groups, primarily within the retail, accounting, and manufacturing industries. Vertex stands out for its strong tax automation engine, deep ERP integrations, and versatile deployment choices.

Vertex’s automated tax dedication engine is very praised. It makes use of intensive jurisdictional content material to use the right charges, exemptions, and guidelines throughout international transactions. G2 reviewers regularly talked about its accuracy and reliability in dealing with complicated tax situations involving a number of tax sorts and layered guidelines. For giant organizations managing hundreds of invoices each day, this stage of precision instantly interprets into elevated audit confidence.

The platform’s returns and remittance administration function simplifies high-volume submitting. It consolidates a number of entities, jurisdictions, and submitting frequencies right into a single workflow. Customers appreciated how they may handle return approvals, corrections, and submissions instantly from inside the system.

Vertex’s international compliance protection additionally acquired constant reward. Past U.S. gross sales tax, it helps VAT, GST, and different worldwide tax regimes, making it notably helpful for multinational producers and distributors. The power to handle multi-country tax knowledge in a single platform reduces the necessity for separate regional programs and ensures alignment between home and international compliance obligations.

Integration flexibility is one other key energy. It integrates deeply with main ERP programs like SAP, Oracle, and Microsoft Dynamics, making certain tax knowledge flows routinely between invoicing, procurement, and reporting environments. Customers preferred that they may keep one supply of reality throughout programs, which helps stop mismatched tax knowledge and handbook changes.

Vertex’s tax knowledge administration capabilities add one other layer of worth for enterprise finance groups. The platform consolidates all tax-relevant documentation, returns, notices, and exemption certificates right into a single searchable digital repository. This makes audit preparation sooner, since groups can retrieve archived information for any jurisdiction or time interval inside seconds. Customers discovered that managing exemption certificates instantly by the system reduces handbook monitoring and improves buyer accuracy throughout tax-exempt gross sales.

The platform’s consumer expertise and stability had been additionally regularly highlighted. Regardless of the complexity of enterprise tax processes, customers discovered Vertex dependable and easy to navigate. As soon as configured, it runs within the background with minimal disruption to ongoing operations, making it a reliable alternative for international finance groups.

Vertex’s buyer help is understood for its technical experience, notably for ERP integrations and large-scale tax implementations. Some customers talked about that the escalation course of can take time, particularly when a number of groups are concerned. For enterprises managing refined setups, this structured help ensures thorough investigation and backbone, although response occasions could sometimes really feel slower than anticipated.

Just a few customers additionally shared that the preliminary system setup and knowledge mapping require detailed coordination with IT or implementation companions. That is largely as a consequence of Vertex’s depth and customization capabilities, which permit it to deal with distinctive tax environments. Whereas onboarding could take longer than less complicated instruments, the top result’s an answer finely tuned to enterprise-level accuracy and compliance calls for.

All-around Vertex is constructed for scale, delivering highly effective automation, international tax protection, and deep ERP integration.

What I like about Vertex:

- G2 reviewers constantly praised Vertex for its accuracy in dealing with complicated, multi-jurisdiction tax calculations. Its international protection and deep ERP integrations make it particularly helpful for enterprise-scale compliance operations.

- Many additionally appreciated the platform’s doc and certificates administration capabilities, which simplify audit preparation and scale back handbook work.

What G2 customers like about Vertex:

“Vertex has been our mainstay for tax dedication and calculation from SAP for a number of years. We like the benefit of producing O-series stories for SUT and VAT reporting, and the tax space IDs in our SAP vendor and buyer grasp routinely.”

– Vertex assessment, Sarah E.

What I dislike about Vertex:

- Some G2 customers talked about that help response occasions could be slower for extremely technical or large-scale implementation circumstances.

- Just a few additionally famous that the onboarding course of requires coordination with IT groups as a result of depth and customization choices of Vertex. Nonetheless, most agreed that the precision and long-term reliability justify the upfront effort.

What G2 customers dislike about Vertex:

“The method round submitting a service request. The documentation and course of to show our case are cumbersome and time-consuming. Analysis needs to be extra proactive, for my part, and meet me midway no less than. I am within the leasing trade, and it’s distinctive. I really feel that I always need to show what I want, quite than researching and making an attempt to grasp. Circumstances are closed with out decision and understanding.”

– Vertex assessment, Monique M.

Associated: For companies centered on managing company filings effectively, take a look at the finest free company tax software program choices that streamline reporting with out added prices.

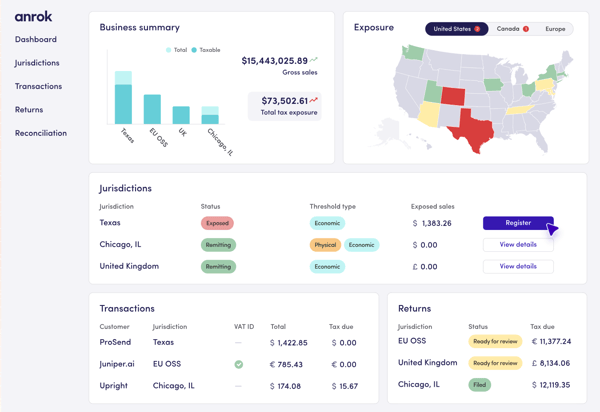

3. Anrok: Finest for SaaS corporations managing recurring income compliance

Anrok is purpose-built for subscription-based and digital-first companies that take care of recurring income, variable utilization, and cross-border clients. Based on G2 Knowledge, 48% of Anrok’s customers are small companies and 52% are mid-market groups, primarily in laptop software program, IT, and accounting.

Its dynamic tax engine is certainly one of its strongest benefits. Fairly than counting on static tables, it recalculates charges and taxability guidelines immediately as new transactions stream in. For SaaS corporations processing hundreds of subscription renewals or variable invoices, this ensures each cost displays correct jurisdiction guidelines. Reviewers famous that this stage of responsiveness prevents errors that usually happen when tax settings lag behind billing updates.

The platform’s automated nexus monitoring makes monitoring compliance thresholds easy. As an alternative of manually reviewing gross sales knowledge, groups can visualize their publicity throughout U.S. states and worldwide areas in actual time. This proactive design helps finance groups determine once they’re nearing registration thresholds earlier than liabilities seem, giving them time to arrange.

Anrok’s return administration and submitting automation additionally earned sturdy suggestions. The system generates, opinions, and submits filings routinely whereas sustaining clear audit trails. Groups can nonetheless approve filings manually, which strikes the fitting stability between automation and accountability. G2 reviewers stated this construction simplifies month-to-month and quarterly filings.

Its SaaS-native integrations are one other standout. Anrok connects instantly with platforms like Stripe, NetSuite, and Chargebee, syncing tax knowledge seamlessly between billing, funds, and accounting programs. These real-time connections decrease reconciliation complications and be certain that tax calculations keep aligned with monetary information. Customers described this as a serious time-saver throughout shut cycles.

The platform additionally helps international VAT and GST compliance, making it appropriate for software program companies with worldwide buyer bases. It centralizes regional tax obligations and reporting, permitting finance groups to handle all jurisdictions by a single dashboard. This consolidation helps keep away from fragmented workflows that usually come up when corporations increase into new markets.

Anrok’s reporting and visualization instruments give groups a transparent snapshot of their compliance well being. The dashboards summarize nexus publicity, submitting progress, and tax legal responsibility tendencies at a look. Reviewers talked about that having all this knowledge centralized lowered their reliance on spreadsheets.

Anrok’s buyer help staff is understood for its deep tax experience and hands-on steering. Some customers talked about that help response occasions could differ, notably when coping with complicated worldwide queries. For groups in search of sooner resolutions, leveraging Anrok’s rising self-service library can usually handle routine setup questions rapidly.

Just a few customers talked about that the platform’s interface may really feel dense at first. The variety of menus and settings displays the system’s depth quite than complexity, and most customers stated the format turns into intuitive as soon as configured. The guided workflows and in-platform ideas make onboarding smoother over time. For a lot of groups, the training curve is a worthwhile trade-off for the visibility and management Anrok offers.

Total, Anrok delivers the automation and agility that trendy SaaS corporations want to remain forward of evolving tax guidelines. It’s a platform designed not simply to calculate tax however to make compliance seamless for recurring-revenue companies.

What I like about Anrok:

- G2 reviewers appreciated Anrok’s means to sync effortlessly with instruments like Stripe, Chargebee, and NetSuite.

- The automation in tax calculation, filings, and nexus monitoring saves groups hours of handbook work whereas conserving recurring-revenue companies compliant throughout areas.

What G2 customers like about Anrok:

“Anrok has allowed us to file tax returns seamlessly and in compliance with restricted effort from the staff. Simple and handy. The Anrok staff could be very immediate and prepared to assist, as they’ll, with any questions or help tickets. Together with program help and outdoors integration troubleshooting. Anytime there was a possible concern, now we have been escalated to the fitting division and staff member swiftly.”

– Anrok assessment, Bailey V.

What I dislike about Anrok:

- Some G2 customers shared that the interface can take time to navigate at first, notably for groups new to automated tax programs.

- Others talked about that help response occasions could gradual throughout peak submitting cycles, although as soon as engaged, the help is detailed and useful.

What G2 customers dislike about Anrok:

“My foremost concern is that after we’re topic to an relevant tax, the platform doesn’t preserve observe or differentiate between the sorts of taxes that we’re topic to. For instance, gross sales tax needs to be damaged out individually from excise tax or gross receipts tax, or the like.”

– Anrok assessment, Mike O.

Associated: Strengthen your compliance and danger posture with the finest GRC software program

trusted by enterprises for governance, danger evaluation, and coverage administration.

4. DualEntry: Finest for real-time transaction-level tax accuracy

DualEntry platform bridges compliance automation with monetary precision, giving groups each management and readability over each recorded transaction. Based on G2 Knowledge, 34% of its customers are small companies and 57% are mid-market groups, primarily in accounting, finance, and manufacturing.

Its transaction-level accuracy is certainly one of its defining strengths. As an alternative of processing taxes on the bill stage, it validates every line merchandise independently, making certain each fee and exemption is utilized appropriately. This granular method makes reconciliations sooner and extra dependable. Customers valued how discrepancies could be traced on to the supply transaction, decreasing time spent on month-end cleanup.

The platform’s submitting coordination system is constructed to deal with high-volume reporting with out shedding oversight. DualEntry organizes filings throughout a number of states and entities inside a single interface, making it simple to trace return standing and remittance schedules. Groups can approve filings individually or in bulk, sustaining the right stability between automation and human assessment.

DualEntry additionally gives granular entry controls for giant groups managing a number of departments or subsidiaries. Permissions could be set by consumer, position, or area, so solely licensed staff members can modify filings or stories. G2 reviewers acknowledged that this fine-tuned management construction enhances inner compliance whereas facilitating collaboration amongst finance, accounting, and tax operations.

The instrument’s audit automation can be extremely praised. It tracks each system interplay with full audit trails, edit histories, and IP logs for every change made. Actual-time alerts flag irregularities immediately, whereas automated approval routing and time-stamped sign-offs streamline assessment cycles. The AI-powered audit assistant additionally helps summarize findings and determine key motion gadgets.

Integration flexibility is one other core energy. DualEntry connects seamlessly with NetSuite, QuickBooks, and Xero, making certain tax knowledge stays constant from calculation to ledger. Customers famous that this computerized synchronization prevents journal entry errors and makes month-to-month closings extra environment friendly. For finance groups prioritizing knowledge integrity, this stage of alignment offers actual peace of thoughts.

Regardless of its depth, it stays simple to navigate. The interface organizes workflows logically, with clear menus for returns, reconciliations, and exemption administration. Customers discovered that after a brief onboarding interval, even complicated filings grew to become easy to handle. The stability between element and ease makes the instrument approachable with out compromising performance.

DualEntry’s structured workflows promote constant, audit-ready processes, although customization choices may very well be broader. Some customers talked about wanting extra management over dashboard layouts or report codecs to match inner templates. The platform’s standardized design ensures knowledge consistency throughout entities, which many groups favor for compliance reliability. For many who prioritize uniformity and traceability, this trade-off helps keep long-term accuracy.

Just a few reviewers additionally talked about that cellular performance continues to be evolving. Whereas the net interface capabilities reliably throughout desktop browsers, customers famous that navigation on smaller screens can really feel restricted. This centered design ensures optimum efficiency and value on full desktop shows. For groups that primarily handle filings from their workstations, this has minimal influence on day-to-day operations. As DualEntry continues to boost cellular help, it stays a powerful answer for on-the-go visibility with out compromising safety.

All in all, DualEntry blends precision, audit readiness, and value right into a single tax compliance setting. It’s finest fitted to groups that worth management and transparency as a lot as automation.

What I like about DualEntry:

- G2 reviewers praised DualEntry’s accuracy and its AI-powered audit options that simplify complicated opinions.

- The instrument’s integrations with accounting programs guarantee each tax report is traceable, dependable, and prepared for audit at any time.

What G2 customers like about DualEntry:

“What I like finest about DualEntry is its means to course of an enormous quantity of information on the identical time with out glitching or overloading. It was additionally spectacular how easy the platform integrations had been that it felt like they had been already a part of the software program itself, like BambooHR, for instance, which our firm makes use of primarily for our enterprise wants.”

– DualEntry assessment, Xaviera Faye B.

What I dislike about DualEntry:

- Some G2 customers talked about that better customization may make the platform much more adaptable to inner workflows.

- Just a few G2 reviewers additionally stated that cellular navigation is much less fluid than desktop, although the principle platform stays extremely steady and user-friendly.

What G2 customers dislike about DualEntry:

“The UI, although clear, may benefit from a number of extra customization choices to swimsuit totally different staff workflows. That stated, the help staff has been very responsive, and as soon as every part is about up, the system runs easily.”

– DualEntry assessment, Ariana D.

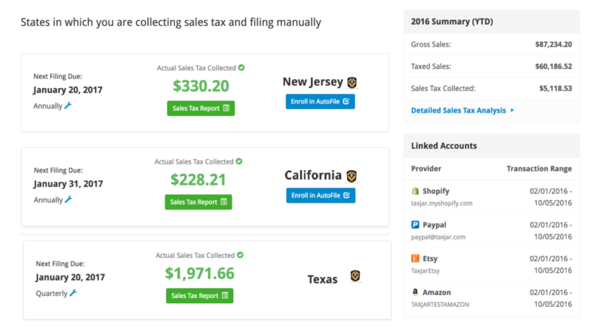

5. TaxJar: Finest for small to mid-sized e-commerce tax automation

Managing gross sales tax throughout a number of states could be overwhelming for small on-line retailers. That’s the place TaxJar is available in. Constructed for e-commerce sellers and small enterprise house owners, it automates fee calculations, submitting, and remittance throughout U.S. jurisdictions. Based on G2 Knowledge, 88% of TaxJar customers are small companies, primarily within the retail, shopper items, and attire and style industries. The platform’s easy setup, sturdy market integrations, and submitting automation make it a dependable compliance companion for sellers managing development and not using a full finance staff.

TaxJar’s automated tax calculation engine is on the core of its worth. It applies state and native gross sales tax charges in real-time, making certain each checkout displays the right whole. G2 reviewers highlighted the dependability of the automation, notably for sellers who use a number of e-commerce channels. The system eliminates the necessity to manually add fee tables or observe tax adjustments, which saves hours of repetitive work every month.

The platform’s AutoFile function is one other spotlight. It routinely recordsdata state gross sales tax returns precisely and on time, utilizing transaction knowledge instantly from e-commerce or ERP programs. This end-to-end course of manages remittance, report preparation, and deadline monitoring routinely. Customers stated that AutoFile removes the handbook burden of researching types or state-specific codecs, decreasing submitting errors and sustaining easy compliance as companies develop.

TaxJar’s nexus monitoring instruments assist companies keep compliant as they increase into new states. The platform displays gross sales thresholds and alerts customers once they’re approaching registration necessities. G2 reviewers stated this function provides them peace of thoughts, particularly throughout high-volume seasons when monitoring compliance manually can be not possible.

Integrations are certainly one of TaxJar’s largest strengths. The platform connects instantly with Shopify, Amazon, WooCommerce, BigCommerce, and QuickBooks, routinely syncing transaction knowledge. These integrations scale back discrepancies and be certain that tax is calculated constantly throughout each storefront. Reviewers famous that setup is simple, with minimal technical steps required to get began.

The instrument’s reporting and reconciliation options had been regularly talked about for his or her readability. TaxJar breaks down transactions by state and submitting frequency, making it simple to double-check tax liabilities earlier than submission. Customers stated the stories are clear, readable, and helpful for each filings and inner audits, even with out intensive accounting experience.

Ease of use is one other space the place TaxJar stands out. G2 reviewers constantly praised its easy and intuitive interface, which makes onboarding quick, even for groups with out devoted finance employees. Every part from connecting shops to reviewing filings could be managed from a single dashboard, making it probably the most user-friendly choices for small companies.

The platform is broadly praised for its automation, accuracy, and reliability, notably amongst small enterprise customers. Nevertheless, there aren’t many current opinions to type a transparent consensus on ongoing challenges. From particular person suggestions, I gathered that whereas most customers see sturdy worth, a number of talked about that pricing can scale with submitting necessities and that protection for sure native jurisdictions, reminiscent of Colorado, could also be restricted. Nonetheless, these notes appeared as remoted experiences quite than widespread considerations.

Total, TaxJar stays a trusted alternative for e-commerce companies that want reliable automation with out complexity.

What I like about TaxJar:

- G2 reviewers constantly highlighted how TaxJar simplifies compliance for small retailers by automation and straightforward integrations.

- Its AutoFile system and correct fee calculations save customers from handbook submitting duties, giving them confidence that every part is submitted appropriately and on time.

What G2 customers like about TaxJar:

“TaxJar saves me actually 20 or extra hours per thirty days, and takes away all of the complications and hassles related to monitoring gross sales tax in a number of states (now we have nexus in 27 states).”

– TaxJar assessment, Asher J.

What I dislike about TaxJar:

- Whereas opinions are largely constructive, there aren’t many current ones to determine a full image of present challenges. Based mostly on particular person suggestions, a number of customers talked about that pricing could be scaled with submitting necessities and that protection for some native jurisdictions may very well be expanded.

What G2 customers dislike about TaxJar:

“I do not like the truth that it is not simple to get buyer help. I’ve to electronic mail my questions and get electronic mail responses.”

– TaxJar assessment, Laura M.

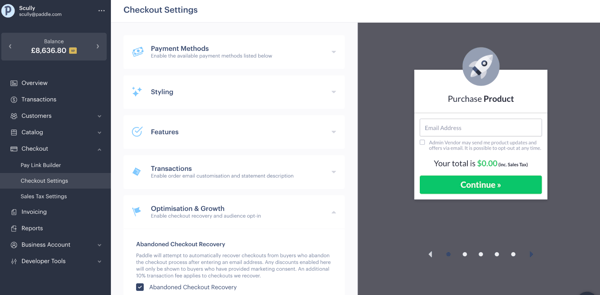

6. Paddle: Finest for international tax compliance in digital product gross sales

Paddle is an all-in-one income supply platform for SaaS companies that handles billing, funds, subscriptions, and tax obligations throughout a number of areas. Based on G2 Knowledge, 92% of Paddle’s customers are small companies, primarily within the software program, IT, and advertising and promoting industries. The platform’s means to mix fee processing with built-in tax compliance makes it a powerful alternative for startups that promote throughout borders with out devoted finance groups.

Considered one of Paddle’s largest benefits is its built-in international tax compliance. Fairly than asking sellers to register in every nation, Paddle handles the tax calculation, assortment, and remittance course of on their behalf. Reviewers famous the worth of this for small groups with out in-house tax experience. The system routinely stays present with worldwide tax guidelines, minimizing the chance of penalties or missed filings.

The platform additionally shines in subscription and recurring billing administration. Paddle automates renewals, upgrades, cancellations, and refunds whereas making certain every transaction consists of the fitting regional taxes. G2 customers stated these automated processes scale back errors and enhance billing transparency for each groups and clients. This makes it notably helpful for SaaS companies with tiered pricing or usage-based fashions.

Paddle’s fee infrastructure simplifies international promoting by supporting a number of fee strategies and currencies. Reviewers appreciated the way it localizes checkout experiences for consumers routinely, serving to to spice up conversions in new markets. Groups additionally preferred not needing separate fee gateways or service provider accounts, as Paddle consolidates every part into one platform.

The platform’s integrations make it even simpler to handle the complete income lifecycle. Paddle connects with instruments like HubSpot, Databox, and Stripe, permitting groups to sync fee, subscription, and buyer knowledge with their current workflows. Reviewers famous that these integrations reduce down on handbook exports and provides finance and operations groups a extra unified view of income and compliance knowledge.

One other function that stood out was Paddle’s developer readiness. The platform offers easy API documentation and versatile plug-ins, making integrations simpler than most enterprise fee programs. Customers reported that the setup required minimal engineering time, which allowed them to concentrate on product development quite than infrastructure.

Buyer help acquired sturdy recognition throughout opinions. Many customers praised Paddle’s onboarding help, mentioning the staff’s responsiveness and experience throughout the preliminary setup and worldwide enlargement. For rising SaaS corporations, this proactive assist made compliance appear far more manageable.

Whereas the help staff is acknowledged for his or her data, that very same thoroughness, for some G2 customers, means response occasions can differ as soon as customers start requesting deeper technical or API-level steering. Groups managing extremely technical configurations could merely have to plan for barely longer decision cycles.

Paddle’s documentation is structured for readability and accessibility, making it simple for many customers to finish customary integrations independently. For builders engaged on superior or extremely custom-made setups, nevertheless, the supplies can really feel fragmented or lack complicated examples. This retains the training curve manageable for non-technical groups, whereas these in search of deeper implementation element could favor to complement with direct help or group steering.

Lastly, it’s price noting that current G2 assessment quantity for Paddle is restricted, making it tougher to gauge newer consumer experiences in 2025. Typically, Paddle delivers what most small software program companies want: reliable automation, peace of thoughts concerning compliance, and a billing system that scales as rapidly as their development.

What I like about Paddle:

- G2 reviewers appreciated how Paddle simplifies international tax compliance for SaaS companies by combining funds, subscriptions, and tax administration on a single platform.

- Its integrations with instruments like HubSpot and Stripe, together with dependable automation, make it simple for small groups to increase internationally with out juggling a number of programs.

What G2 customers like about Paddle:

“What I like most about Paddle is how simple the platform is to make use of — the interface is intuitive and easy, which makes managing funds a breeze. The help staff is totally succesful and at all times prepared to assist or reply any questions promptly, which supplies a number of confidence. I additionally recognize the choice to just accept funds in a number of currencies, which makes it simpler to promote globally. One other nice function is the flexibility to move on fee taxes and costs to the shopper, which helps preserve prices clear and manageable for the vendor.”

– Paddle assessment, Mateus N.

What I dislike about Paddle:

- Just a few G2 reviewers famous that help response occasions can differ, notably for extra complicated points or superior configurations.

- Some additionally urged that the documentation may very well be extra in-depth for complicated API use circumstances. Latest assessment quantity on G2 is restricted, however the total sentiment nonetheless displays confidence in Paddle’s automation and reliability.

What G2 customers dislike about Paddle:

“When going dwell, we confronted some points, and to start with, the extent of help was not ample. However to be truthful, Paddle has taken our complaints severely and improved the standard of their help drastically. It took a while, however now we’re at a stage the place we’re proud of the help, and I am positive Paddle has realized from this expertise.”

– Paddle assessment, Sven L.

Continuously requested questions on the very best gross sales tax compliance software program

Whether or not you got here right here questioning which VAT compliance software program is very rated or what’s essentially the most really useful gross sales tax software program for startups, I hope you discovered your solutions. If in case you have extra questions, now we have some FAQs for you.

Q1. What are the main gross sales tax compliance software program within the U.S.?

The main gross sales tax compliance options within the U.S. embrace Avalara, Vertex, and TaxJar. Avalara is widely known for its automated fee updates and multi-jurisdiction submitting capabilities. Vertex stands out for enterprise-grade accuracy and ERP integrations, whereas TaxJar simplifies gross sales tax compliance for small and mid-sized e-commerce companies.

Q2. What’s the finest gross sales tax compliance software program for small companies?

For small companies, TaxJar, Anrok, and Paddle are sturdy contenders. TaxJar automates U.S. filings for on-line sellers and integrates instantly with Shopify, Amazon, and WooCommerce. Anrok caters to SaaS corporations with subscription-based billing, whereas Paddle helps small digital companies handle each funds and international VAT obligations.

Q3. What’s the very best gross sales tax compliance instrument for tech corporations?

Tech and SaaS corporations usually favor Anrok and Paddle. Anrok automates tax calculations for recurring and usage-based billing, whereas Paddle handles VAT, GST, and gross sales tax globally below a merchant-of-record mannequin. DualEntry is an alternative choice for finance groups that need real-time, transaction-level accuracy and audit-ready reporting.

This autumn. What’s the very best software program to deal with gross sales tax and VAT compliance?

If your enterprise operates globally, Avalara and Vertex provide essentially the most complete gross sales tax and VAT compliance options. Avalara offers automation for each U.S. and worldwide jurisdictions, whereas Vertex helps multi-country filings, exemptions, and superior reporting.

Q5. What are the top-rated tax compliance apps for companies?

Based mostly on G2 Knowledge, the top-rated tax compliance software program consists of Avalara, Vertex, and Anrok. Every instrument ranks extremely when it comes to automation, accuracy, and ease of integration.

Q6. What’s the best choice for gross sales tax compliance in on-line companies?

For e-commerce and on-line sellers, TaxJar is among the finest choices. It automates U.S. gross sales tax filings, tracks nexus thresholds, and integrates seamlessly with main platforms like Shopify, Amazon, and QuickBooks. G2 reviewers praised it for saving time and making certain submitting accuracy for small and mid-market on-line shops.

Q7. What’s the popular VAT software program for international corporations?

World enterprises usually depend on Vertex or Avalara for VAT administration. Vertex offers intensive worldwide tax protection with configurable workflows, whereas Avalara simplifies multi-region compliance by automation and standardized reporting.

The next step towards easy tax compliance

Tax compliance may by no means be easy, however with the fitting software program, it doesn’t need to be demanding. The six instruments I evaluated stand out as a result of they don’t simply calculate charges; they automate the complete compliance course of, from nexus monitoring and submitting to audit preparation.

For giant enterprises, Vertex and Avalara ship unmatched precision and scalability. SaaS and subscription-based companies will discover Anrok and Paddle supreme for automating complicated recurring income taxes. In the meantime, DualEntry brings readability to transaction-level accuracy, and TaxJar stays a go-to answer for small retailers in search of dependable automation with out the complexity of enterprise programs.

Every of those platforms earned its place on this listing as a result of actual G2 customers confirmed their reliability, automation depth, and influence on day-to-day tax administration. Whether or not you’re promoting digital merchandise, managing cross-border transactions, or submitting in a number of states, these instruments make compliance much less about chasing deadlines and extra about operating your enterprise with confidence.

If you happen to’re managing international groups or seeking to simplify cross-border funds, discover our information on the finest multi-country payroll software program to finish your international compliance stack.