Understanding the price of a million-dollar life insurance coverage coverage could be pivotal in securing your loved ones’s monetary future. However have you ever ever questioned simply how accessible or pricey such a coverage could be?

Do you assume a million-dollar time period life insurance coverage coverage feels like an excessive amount of insurance coverage?

As a Licensed Monetary Planner,I see underinsured folks on daily basis.

What do I inform them?

1,000,000-dollar time period life insurance coverage coverage may truly be the minimal protection wanted for the everyday middle-class family,but it surely’s inexpensive.

Which may sound like an exaggeration,however if you happen to crunch the numbers – simply as we’ll be doing a bit of bit – you’ll understand{that a}million-dollar coverage could be simply what you want.

The excellent news is time period life insurance coverage isn’t almost as pricey as most individuals assume.

What makes time period life insurance coverage even higher is that bigger insurance policies price much less on a per thousand foundation than smaller insurance policies do. It’s possible you’ll discover the premium on a $1 million coverage is just a bit of bit increased than it’s for $500,000.

Do You Actually Want a $1 Million Time period Life Insurance coverage Coverage?

Most likely,however let’s discover out. A common rule of thumb is that it is best to get 10x your earnings as baseline protection for all times insurance coverage.

Should you’re younger,which may be low as a result of chances are you’ll need to present your loved ones with sufficient to interchange your earnings for 15 years or extra.

As we speak,$1 million has develop into the brand new baseline for life insurance coverage by a main breadwinner. Something much less might depart your loved ones financially impaired.

Typical Obligations to Add When Calculating the Quantity You Want

Right here’s an inventory of all of the completely different obligations chances are you’ll need to have life insurance coverage cowl within the unlucky occasion you go away early.

- Your Revenue (And for How Many Years)

- Any Debt You Could Need to Be Settled

- Future Obligations Comparable to School for Youngsters

- Different Obligations Comparable to Enterprise

- Typical Gadgets You Can Subtract When Calculating the Quantity You Want

- Present Life Insurance coverage Insurance policies

- Belongings (Like Money or Inventory) You May Select to Use As a substitute of Life Insurance coverage

Now that you’ve got an thought of those obligations,let’s punch them into this life insurance coverage calculator to seek out out if you happen to want a million-dollar coverage.

Selecting A Million Greenback Insurance coverage Coverage

In line with CoverageGenius,the typical price for a 20-year $1 million time period life insurance coverage coverage for a 35-year-old male is $53 per 30 days. Nonetheless,your charge will range in line with the next components.

Elements that have an effect on your charge:

- Your Protection Quantity and Coverage Time period

The place to begin?

The very best,and best place to begin is on-line. I like to recommend having two or three insurers compete for your enterprise to be sure you get the very best charge and protection. To see how low-cost time period life could be,select your state from the map above to be matched with prime life insurance coverage suppliers immediately.

Elements That Have an effect on How A lot You Want

Let’s take a look at the person parts that may rapidly add as much as over a million-dollar coverage.

Revenue Alternative

That is the place issues can get a bit intimidating. Even if you happen to earn a modest earnings,chances are you'll want near $1 million to interchange that earnings after your dying with a purpose to present for your loved ones’s primary residing bills.

The standard knowledge within the insurance coverage business is that it is best to preserve a life insurance coverage coverage equal to between 10 instances and 20 instances your annual earnings. So if you happen to earn round $50K per yr, that may imply coverage protection between $500K and $1 million.

The complication right now is that with rates of interest being as little as they're which may not be sufficient both.

For instance,when you have a $1 million coverage that might be invested at 5% per yr,your loved ones might reside on the curiosity earned – which conveniently involves $50,000 per yr – for the subsequent 20 years.

That may nonetheless depart the unique $1 million intact to cowl different bills. However with right now’s microscopic rates of interest,there’s no technique to get a assured return of 5% in your cash,definitely not for 15 or 20 years.

EXPERT TIP

That brings us again to basic math – multiplying your annual earnings instances the variety of years your loved ones’s residing bills will must be lined. This alone can require a $1 million life insurance coverage coverage.

Additionally,understand that most insurance coverage firms have a most multiplier you'll be able to apply to your earnings for all times insurance coverage protection. For instance, it wouldn’t make a lot sense for a 22-year-old making $27,000 per yr to get a $2 million life insurance coverage. Or a 65-year-old that's retired to safe a $3 million greenback coverage.

The desk beneath is roughly how a lot you’re allowed to multiply your earnings primarily based in your age and earnings:

| Applicant’s Age | Annual Revenue Multiplier |

| 18-29 | 35x |

| 30-39 | 30x |

| 40-49 | 25x |

| 50-59 | 20x |

| 60-69 | 15x |

| 70-79 | 10x |

| 80+ | 5x |

Utilizing the desk above as a information,a 35-year-old making $150,000 per yr could be capped at taking out a $4.5 million time period coverage ($150,000 x 30=$4,500,000).

Your Ultimate Bills

Right here we begin with the fundamentals – wrapping up your last affairs.

This may embrace funeral prices and any lingering medical prices. An affordable estimate for a typical funeral is round $20,000.

Loopy,proper? You will get burial insurance coverage to cowl solely probably the most primary of ultimate bills.

Excellent Debt

Debt burdens are excessive within the US,and debt could be particularly crushing on remaining members of the family. Many life insurance coverage prospects ensure that they will repay most of their debt with the coverage.

Medical Debt

Medical prices are a severe variable. Even when you have glorious medical insurance,there are prone to be unpaid medical payments lingering after your dying. This has to do with copayments,deductibles,and coinsurance provisions.

Collectively,they will add as much as many 1000's of {dollars}. However the place issues get actually difficult is if you happen to die of a terminal sickness.

For instance, if you're laid low with an sickness that lasts for a number of years,you could possibly incur numerous bills that aren't lined by insurance coverage. This may occasionally embrace the price of private care and even experimental therapies.

Mortgage

A house could also be a big asset, but it surely’s additionally typically a house owner’s largest debt. The typical mortgage stability within the US is roughly $236,443 in line with Experian information. So you could possibly simply use a life insurance coverage coverage to repay that debt and relieve your family members of a month-to-month mortgage fee.

Private Debt

Bank card debt and different private debt are among the costliest obligations carrying charges upward of 20% in some circumstances. Ensure you have sufficient to cowl this very costly debt.

Future Obligations For Your Household

Under is a sampling of main bills your loved ones is prone to incur, both on an annual foundation or in some unspecified time in the future after your dying.

School

Tuition prices proceed to skyrocket. The Division of Training means that four-year public faculty tuition has been rising a mean of 5% per yr, far exceeding the speed of inflation. If in case you have one baby who attends an in-state public college, a second at an out-of-state public college, and a 3rd in a non-public college, the overall expenditure will attain $416,560.

- Annual price at in-state public faculty: $20,770 ($83,080 for 4 years)

- Annual price at out-of-state public faculty: $36,420 ($145,680 for 4 years)

- Annual price at a non-public faculty: $46,950 ($187,800 for 4 years)

Transportation

Autos and different types of transportation symbolize one other giant sum. Sadly, with rising electronics and security options, the typical price of a brand new automotive continues to develop.

Well being Insurance coverage

If your loved ones depends in your work for healthcare, take discover. In line with eHealth.com, the typical medical insurance premium for a household is $22,221. That’s a shade beneath $2,000 per 30 days in further price. This price will solely rise, and the necessity might final for years.

Different Obligations You Could Have to Cowl

Thus far, we’ve been describing the monetary obligations prone to have an effect on a typical family.

However there could also be sure conditions that can produce obligations which are much less apparent.

Enterprise Homeowners

For instance, if you happen to’re a enterprise proprietor, there could also be money owed or different monetary obligations that can must be paid upon your dying.

Despite the fact that nobody in your loved ones could also be certified or fascinated about taking up your enterprise, the payoff of these obligations could also be utterly essential to allow the sale of the enterprise.

Actual Property Investor

One other chance is that you just’re an actual property investor.

In case your properties are closely indebted, further insurance coverage proceeds could also be needed both to hold the properties till they’re offered, and even to repay current indebtedness to release money stream for earnings.

It's possible you'll even want further funds if you're taking good care of an prolonged member of the family,like an growing old mother or father.

These are simply among the many prospects of bills that can must be lined by insurance coverage proceeds.

Elements Affecting Your Life Insurance coverage Premiums

Earlier than we transfer on to particular life insurance coverage quotes,let’s first contemplate the components that have an effect on time period life insurance coverage premiums.

Age

That is sometimes the one most essential premium issue. The older you might be,the extra possible you might be to die inside the time period of the coverage.

Well being

It is a shut second and why it’s so essential to use for a coverage as early in life as attainable. Premiums on life insurances charges actually improve by every year.

If in case you have any well being circumstances which will have an effect on mortality,equivalent to diabetes or hypertension,your premiums will likely be increased. That is one other compelling cause to use when you are younger and in good well being.

It’s not that insurance policies aren't accessible to folks with well being circumstances, it’s simply that they’re cheaper if you happen to don’t have any.

Coverage Time period

A ten-year time period coverage can have a decrease premium than a 20-year time period coverage, which will likely be decrease than a 30-year time period. The shorter the time period, the much less possible it's the insurance coverage firm must pay a declare earlier than it expires.

Coverage Dimension

Dimension of the coverage issues,however not the way in which you may assume. Sure,a $1 million coverage will price greater than a $500,000 coverage. Nevertheless it gained’t price twice as a lot.

The bigger the coverage,the decrease the per-thousand price will likely be.

When the dimensions of the dying profit is taken into account,the bigger coverage will at all times be less expensive.

Work,Hobbies,and Habits

For instance,sure occupations are extra hazardous than others (assume policeman versus librarian). Deep-sea diving is increased danger than golf. And smoking is the one exercise assured to lift your premiums considerably.

With this data in thoughts,let’s check out whether or not it is best to contemplate a $1 million complete life coverage as a substitute.

$1 Million Time period Life Insurance coverage vs Entire Life?

Any dialogue on life insurance coverage ought to embrace a comparability of complete life and time period life insurance coverage protection. In any case,each merchandise could be immensely helpful in the fitting scenario,but one product (complete life) prices significantly greater than the opposite.

More often than not,the talk is settled in favor of time period life insurance coverage primarily based on price alone.

With that being stated,complete life insurance coverage and different investment-type life insurance coverage protection could be helpful when it comes to the money worth you'll be able to construct up over time. Entire life insurance coverage additionally affords a set profit quantity on your heirs that can final on your complete life, but the price of your premiums are assured to remain the identical.

The money worth of an entire life insurance coverage coverage additionally grows on a tax-deferred foundation, and you'll borrow towards this quantity if you happen to want a mortgage. Additional,many complete life insurance policies from respected suppliers additionally pay out dividends throughout good years,which could be substantial.

Why Younger Households Select Time period Protection

The issue with complete life and different comparable insurance policies like common life is the truth that premiums could be exorbitant for the quantity of protection you may want.

A pair with younger kids gives a superb instance since they may want a $1 million greenback coverage or extra to supply earnings safety for his or her working years and have cash left for school tuition and different bills.

With younger households,bills are already excessive.

This consists of prices for meals for a household,childcare,heavy use of well being care,and the seemingly infinite demand for clothes,furnishings,and even leisure as the kids develop.

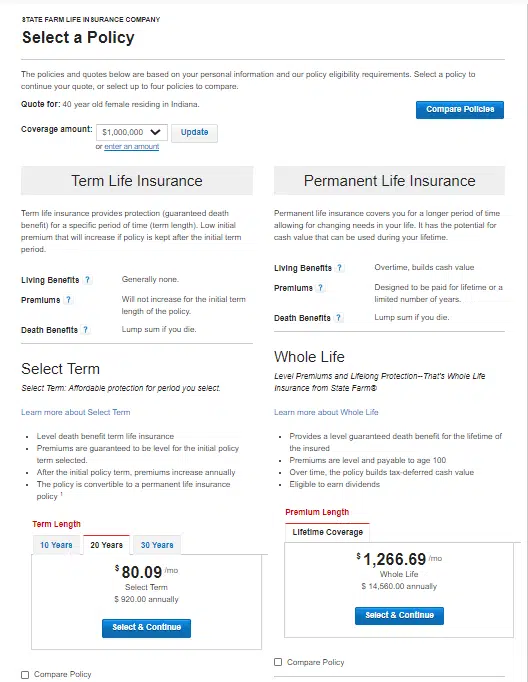

As you'll be able to see from the associated fee comparability beneath from State Farm, there’s not sufficient room within the typical household finances to afford the sort of life insurance coverage that’s wanted.

A 40-year-old mom and breadwinner in glorious well being would pay $80.09 per 30 days for a time period life coverage that lasts 20 years, whereas an entire life coverage in the identical quantity would price $1,266.69 per 30 days (or $14,560 yearly).

It is a traditional scenario the place time period insurance coverage rides to the rescue. The household can afford to purchase the quantity of protection they want at an inexpensive value, whereas paying for everlasting life insurance coverage protection in the identical quantity could be troublesome to justify.

And simply as essential for folks of any age and in any circumstance, the additional funds not being spent on insurance coverage premiums could be invested to steadily enhance your monetary scenario.

So completely, time period insurance coverage will work finest for most individuals.

$1 Million Life Insurance coverage Fee Examples

As you’ll discover, every desk has a big selection of data. Realizing that everyone is in a unique scenario, I needed to guarantee that I supplied time period life quotes for nearly each conceivable scenario.

I’ve included life insurance coverage charges for a 30-year time period, 20-year time period, and a 10-year time period million greenback life insurance policies. Should you’re a tobacco person, I’ve additionally included some quotes from life insurance coverage for people who smoke.

30-12 months $1 Million Time period Life Coverage

For people who assume {that a} million-dollar time period coverage is dear, you’ll rapidly discover {that a} 25-year-old male in good well being solely prices $645 per yr whereas a 35-year-old prices $795.

On a month-to-month foundation that’s virtually subsequent to nothing!

| AGE | SEX | COMPANY 1 | COMPANY 2 | COMPANY 3 |

|---|---|---|---|---|

| 25 | MALE | BANNER LIFE $645 |

NORTH AMERICAN CO. $645 |

TRANSAMERICA $650 |

| 25 | FEMALE | AMERICAN GENERAL $514 |

NORTH AMERICA CO. $515 |

SBLI $520 |

| 35 | MALE | BANNER LIFE $795 |

GENWORTH FINANCIAL $804 |

ING $808 |

| 35 | FEMALE | SBLI $640 |

AMERICAN GENERAL $694 |

GENWORTH FINANCIAL $695 |

| 45 | MALE | BANNER LIFE $1,885 |

GENWORTH FINANCIAL $1891 |

AMERICAN GENERAL $1,894 |

| 45 | FEMALE | SBLI $1,450 |

BANNER LIFE $1,455 |

AMERICAN GENERAL $1,456 |

20-12 months $1 Million Time period Life Coverage

There's a huge drop-off in life insurance coverage charges between a 20 yr and a 30 yr since underwriters would not have to fret as a lot about life expectancy.

For many individuals,a 20-year coverage will get them precisely the place they need to be in life when the coverage time period runs out.

| AGE | SEX | COMPANY 1 | COMPANY 2 | COMPANY 3 |

|---|---|---|---|---|

| 25 | MALE | AMERICAN GENERAL $414 | BANNER LIFE $425 | SBLI $440 |

| 25 | FEMALE | AMERICAN GENERAL $354 | SBLI $360 | BANNER LIFE $365 |

| 35 | MALE | SBLI $450 | BANNER LIFE $455 | NORTH AMERICA CO. $485 |

| 35 | FEMALE | SBLI $390 | AMERICAN GENERAL $404 | BANNER LIFE $405 |

| 45 | MALE | BANNER LIFE $1,155 | SBLI $1,160 | GENWORTH FINANCIAL $1,173 |

| 45 | FEMALE | SBLI $880 | BANNER LIFE $895 | TRANSAMERICA $930 |

10-12 months $1 Million Time period Life Coverage

As soon as once more,you get a $200 drop within the annual premium by dropping one other 10 years on the time period.

In case your life insurance coverage agent isn’t providing you with all these time period choices and is just targeted on the dying profit,you then want a unique agent.

| AGE | SEX | COMPANY 1 | COMPANY 2 | COMPANY 3 |

|---|---|---|---|---|

| 25 | MALE | SBLI $260 | BANNER LIFE $285 | MINNESOTA LIFE $290 |

| 25 | FEMALE | SBLI $230 | BANNER LIFE $245 | ING $248 |

| 35 | MALE | SBLI $270 | BANNER LIFE $295 | MINNESOTA LIFE $300 |

| 35 | FEMALE | SBLI $240 | BANNER LIFE $255 | ING $258 |

| 45 | MALE | BANNER LIFE $585 | TRANSAMERICA $630 | GENWORTH FINANCIAL $637 |

| 45 | FEMALE | SBLI $520 | BANNER LIFE $525 | ING $528 |

$1 Million Coverage for People who smoke – Charges Improve

For all you people who smoke on the market – beware! The price of your life insurance coverage balloons as you’ll see right here. Should you’re contemplating kicking the behavior,now could be pretty much as good time as any.

Some life insurance coverage firms gives you a decrease charge if you happen to full a acknowledged smoking cessation program,and go on with out smoking for a minimum of two years.

It gained’t assist your instant scenario,however if you see the premium on smoker life insurance coverage charges beneath,you may agree that it’s one thing to work towards!

| AGE | SEX | COMPANY 1 | COMPANY 2 | COMPANY 3 |

|---|---|---|---|---|

| 35 | MALE | North American Co. $3595 | SBLI $3630 | MetLife $3639 |

| 35 | FEMALE | North American Co. $2555 | Transamerica $2720 | Prudential $2765 |

10 steps to securing 1,000,000 life insurance coverage coverage:

Should you’ve made the choice that $1 million of life insurance coverage is the correct quantity of protection you want and also you’re able to buy a coverage,listed below are the steps you’ll have to comply with.

1. Decide How A lot Protection You Want:That is the primary and most essential step in securing 1,000,000 life insurance coverage insurance policies. You must have a transparent understanding of how a lot protection you really want.

2. Select the Proper Kind of Coverage:There are complete life,time period life,and Common life insurance policies accessible. Select the one which most accurately fits your wants.

3. Store Round:Don’t simply go along with the primary life insurance coverage firm you come throughout. It’s essential to check life insurance coverage charges and protection from a couple of completely different firms earlier than making a call.

4. Take into account Your Well being:Should you’re in good well being,you’ll possible qualify for decrease charges. Nonetheless,when you have well being points,you should still be capable of get protection,however it's going to most likely be costlier.

5. Take into account Your Life-style: If in case you have a dangerous job or pastime, that would have an effect on your charges.

6. Get Quotes From A number of Corporations: That is one of the simplest ways to check charges and discover the most cost effective coverage.

7. Learn the Advantageous Print: Ensure you perceive all of the phrases and circumstances of the coverage earlier than shopping for it.

8. Purchase On-line: You'll be able to normally get cheaper charges by shopping for life insurance coverage on-line.

9. Pay Consideration to Your Fee Schedule:Most life insurance coverage insurance policies require month-to-month or annual funds. Make certain you'll be able to afford the funds earlier than shopping for a coverage.

10. Assessment Your Coverage Frequently: Life adjustments, and so do life insurance coverage wants. You should definitely evaluate your coverage repeatedly to verify it nonetheless meets your wants.

Following these steps will allow you to get the very best charge on a million-dollar life insurance coverage coverage.

Ensure you perceive all of the phrases and circumstances earlier than signing on the dotted line. Additionally, ensure that to buy round and examine charges from a number of firms earlier than shopping for a coverage.

Sure, I do know I’ve stated that a couple of instances on this article, but it surely’s price repeating. Many individuals go along with the primary life insurance coverage firm they name, and that isn’t sort to their checkbook. It pays to buy round.

Right here’s what it's essential find out about selecting the very best life insurance coverage firm on your $1 million coverage:

The Finest Corporations to Buy $1 Million Life Insurance coverage

When selecting the very best life insurance coverage firm,it’s essential to think about the general monetary well being of the insurance coverage firm. You need to ensure that the corporate you select is steady and will likely be round for years to return. You additionally need to contemplate issues like the corporate’s customer support score and claims-paying skill.

There are plenty of completely different life insurance coverage firms on the market,so it may be troublesome to know which one is the very best. Every firm is rated by completely different organizations,so it’s essential to take a look at a number of rankings earlier than making a call.

The businesses that charge insurance coverage firms are A.M. Finest,Moody’s,and Commonplace &Poor’s.

A.M. Finest is a credit standing company that focuses on the insurance coverage business. They charge insurance coverage firms on their monetary stability.

Moody’s is one other credit standing company. Additionally they charge insurance coverage firms on their monetary stability.

Commonplace &Poor’s is a credit standing company that charges firms on their monetary stability.

The next life insurance coverage firms are all rated A+(Superior) by A.M. Finest and are thought of to be financially steady and have a superb claim-paying skill.

1. Northwestern Mutual

2. New York Life

3. MassMutual

4. Guardian Life

5. State Farm

6. Nationwide

7. USAA

8. MetLife

9. The Hartford

10. Allstate

Listed below are those self same prime life insurance coverage firmswith their respective rankings:

| Firm | AM Finest | Moody’s | Commonplace &Poor’s |

| Northwestern Mutual | A++ | Aaa | AA+ |

| New York Life | A++ | Aaa | AA+ |

| MassMutual | A++ | A2 | AA+ |

| Guardian Life | A++ | Aa2 | AA+ |

| State Farm | A++ | A1 | AA |

| Nationwide | A+ | A1 | A+ |

| USAA | A++ | Aa1 | AA+ |

| MetLife | A- | A3 | A- |

| The Hartford | A+ | A1 | A+ |

| Allstate | A+ | A3 | A- |

These are only a few of the numerous life insurance coverage firms on the market that would give you a $1 million life insurance coverage coverage.

When selecting a life insurance coverage firm,it’s essential to think about their monetary stability,customer support score,and claims-paying skill. The businesses listed above are all rated A+(Superior) by A.M. Finest and are thought of to be financially steady with a superb claims-paying skill.

Northwestern Mutual,New York Life,MassMutual,Guardian Life,State Farm,Nationwide,USAA,MetLife,The Hartford,and Allstate are all good decisions for all times insurance coverage firms.

You'll be able to’t put a value on peace of thoughts, and with a $1 million life insurance coverage coverage you'll be able to have the peace of thoughts figuring out that your family members will likely be taken care of financially if one thing occurs to you.

Backside Line:How A lot Does A $1 Million Greenback Life Insurance coverage Coverage Value?

Getting a one-million-dollar time period life insurance coverage coverage just isn't as costly as most individuals consider. You can begin getting quotes right now from a wide range of prime life insurers by choosing your state from the map above.

Even those that go for the costlier everlasting life insurance coverage coverage will many instances be stunned on the value.

Both method, you will get these bigger quantities of protection and nonetheless not break the financial institution. However get your coverage now, when you’re nonetheless younger and in good well being.

FAQ’s on $1 Million Life Insurance coverage Coverage

The price of a $1,000,000 life insurance coverage coverage will range primarily based on components like your age, well being, and life-style. Nonetheless, you'll be able to count on to pay round $250 per yr for a wholesome 30-year-old. In line with Ladder Life,a $1 million time period life coverage for wholesome 30-year-old males prices round $2.08 per day.

A $1 million time period life insurance coverage coverage is a sort of life insurance coverage that gives protection for a selected time period,normally 10-20 years. Should you die throughout the time period of the coverage,your beneficiaries will obtain a dying good thing about $1 million. Should you reside previous the time period of the coverage,the coverage will expire and you'll not obtain any dying profit.

A $1 million time period life insurance coverage coverage is an effective selection for individuals who need to ensure that their family members are taken care of financially if one thing occurs to them. It can be a sensible choice for folks with plenty of debt, like a mortgage or scholar loans, that they need to ensure that is paid off in the event that they die.

For probably the most half, sure; however there are examples of people that can not purchase life insurance coverage. As an example, folks with a terminal sickness or those that have been identified with a life expectancy of fewer than two years aren't in a position to buy life insurance coverage insurance policies.

The opposite components are your earnings,affordability,and suitability. Should you can not afford the premiums,you then won't be able to buy the coverage. And in case your earnings is say lower than $50,000 then the insurance coverage firm could not assume it’s appropriate to buy a $1 million life insurance coverage coverage.

1,000,000-dollar life insurance coverage coverage might not be proper for everybody, however it may be a good suggestion when you have plenty of debt or if you wish to ensure that your loved ones is taken care of financially if one thing occurs to you.

Nobody likes to consider their dying, but it surely’s essential to have a life insurance coverage coverage in place in case one thing occurs to you. 1,000,000-dollar life insurance coverage coverage can provide you and your beloved’s peace of thoughts figuring out that they are going to be taken care of financially if one thing occurs to you.

There isn't any one-size-fits-all reply to this query,as the very best coverage for you'll rely in your particular wants and preferences. Nonetheless, among the prime suppliers of million-dollar life insurance coverage insurance policies embrace AIG, Banner Life, and Prudential. So you'll want to discover your choices and examine quotes from completely different suppliers earlier than making a call.

Sure,insurance coverage firms supply million-dollar insurance coverage insurance policies with no medical examination. Nonetheless,the premiums for these insurance policies are sometimes a lot increased than for insurance policies with a medical examination.