As mentioned previously, index rebalancing dates tend to have larger exit auctions. That’s because most index funds try to exactly match the activity of the index provider, and index changes are made using official closing prices.

For example, a typical closing price accounts for less than 10% of the day’s trading volume. On the other hand, some index rebalancing days see more than 30% of trading volume at the close.

Based on this knowledge, we can use the size of the closing trade on the index addition date to estimate the index fund’s total tracking. The results suggest that for many companies, about a quarter of their total float may be purchased by various index funds.

It is important to note that companies benefit from being added to major indexes as they are expected to attract significant new investors (and usually long-term investors).

The trading amount will be larger on index rebalancing days.

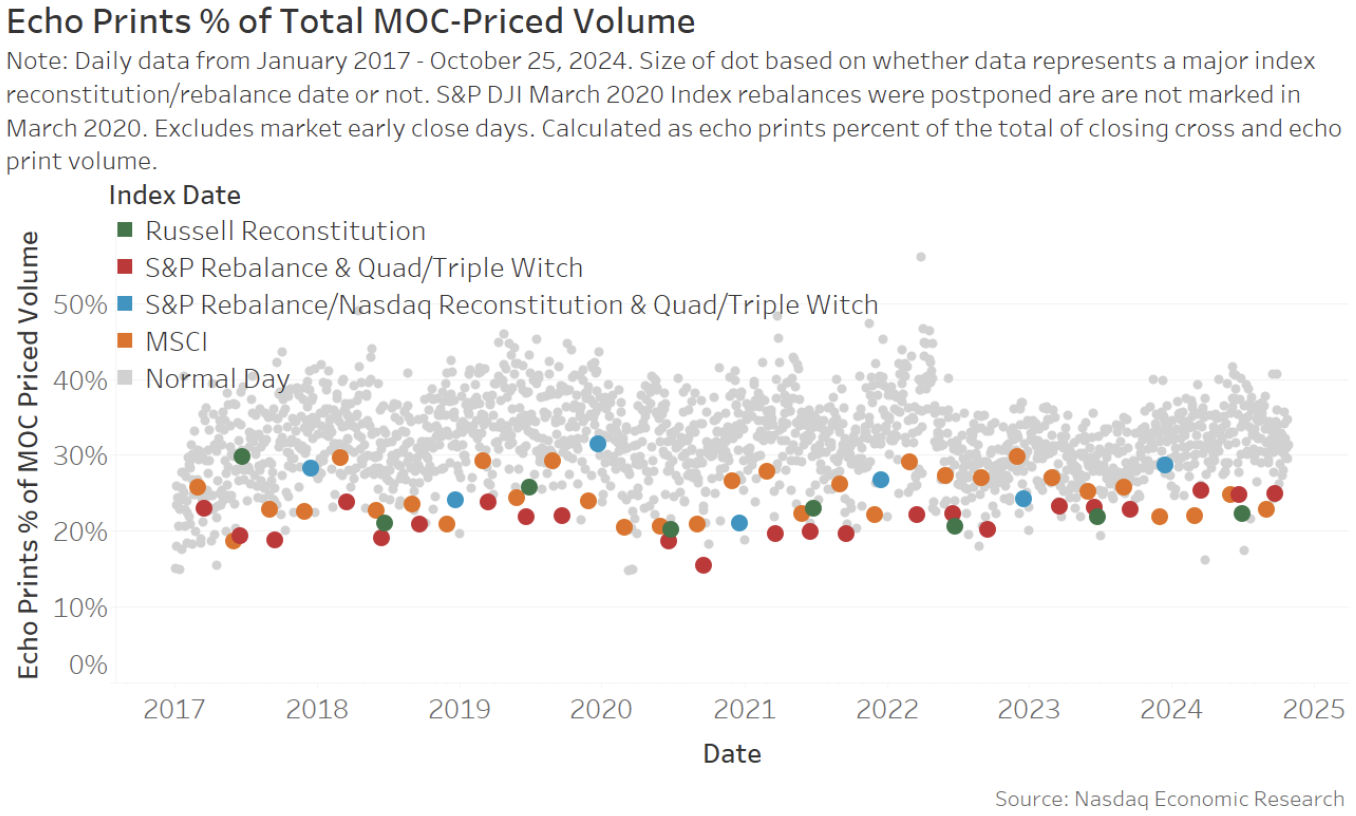

As the data in the graph below shows, several dates Index trading is typically done every year.

- MSCI is (usually) at the end of May and end of November. The S&P, Nasdaq, and FTSE indexes are rebalanced on the third Friday of the last month of the quarter. Since this day is also “Quad Witch” day, the closing volume will be even higher.

- Russell rebalances its index once a year, typically on the last Friday of June. do not have End of the quarter.

Chart 1: Index rebalancing day records very high trading volume

Currently, approximately $40 billion of trades are added to the normal closing price, which is less than 10% of intraday trading volume (gray dots).

In contrast, the S&P and Russell indices had an average of $240 billion in trades on the day, an increase of over 30% of the day’s closing price, and a significant increase in total intraday trading volume (ADV). Masu. MSCI rebalancing also increases the closing price to approximately 20% of ADV.

Estimate index tracking using closing trades

There are two ways to estimate the additional amount of index funds that track each index.

- top down: Possibly an index provider disclose Amount to track the index. some scholar We also summed up all index fund holdings from our 13F filings. One could try to reconcile that with ICI’s disclosure that index funds currently account for about 50% of all mutual funds.

- bottom up: Another method is behavioral. It is to find out how many stocks are actually traded on the index rebalancing date. That index funds actually only need to be traded on rebalancing days, and in order to accurately track the index. in front When the market opens the next day, many funds like to trade at the same time as the benchmark changes (that’s the closing price!). This represents another way to see how big an index fund is.

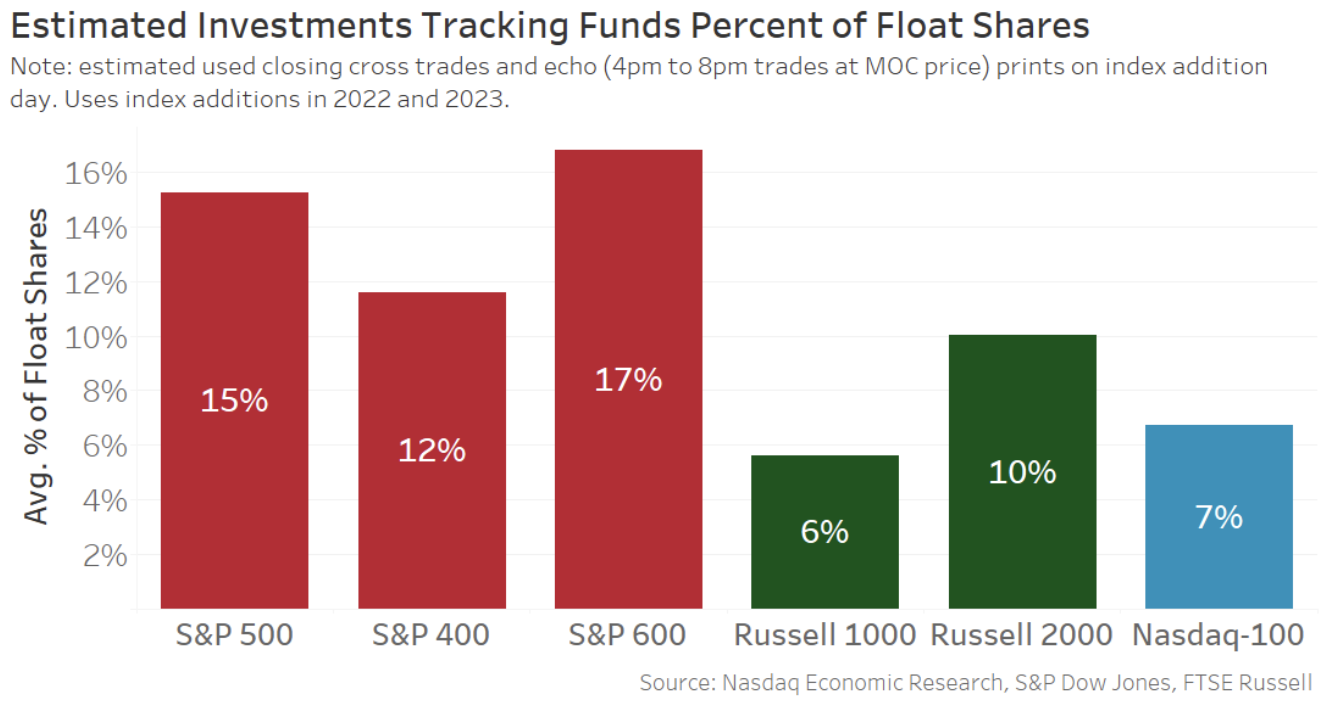

Currently, we use a bottom-up approach to see how much free float actually trades on rebalancing dates across the major US indexes. The results (graph 2) show that:

- In fact, small-cap stocks account for a large portion of index movement, totaling 27% for the S&P 600 and Russell 2000.

- Large-cap stocks can be covered by all three major indexes, including the Nasdaq 100®, but up to 28% of their float can be held in index funds.

Even though far more dollars are indexed in the S&P 500; $7.5 trillionwhat we are measuring here is each company’s percentage of free float, which should be consistent across all companies in each index.

Figure 2: Index-day closing trades show that index-tracking funds may hold approximately 25% of the free float of many companies.

Importantly, neither top-down nor bottom-up approaches are perfect. some futures and options Hedging may be traded similarly to index funds, but actual index funds may pre-establish positions to limit the market impact of predictable index trading. Others argue that some active funds trade like “closet indexers.”

Closing volume must also include off-exchange trades

Off-exchange trading is becoming increasingly large. The same goes for closing.

Both exchanges and brokers can issue so-called “echo prints” that copy the official closing price (MOC), but on “tape” after the official closing price is known.

For this study, we add echo print trades that occur between 4:00 PM and 8:00 PM and occur at MOC prices to the “MOC volume” used above. Interestingly:

- On a typical day, we see that the echo print averages about 30% of the MOC volume (gray dot in chart 3).

- On index rebalancing days, the official closing price appears to be more important, as approximately 20% of all trades have echo prints added to them.

Chart 3: Echo Print Contributes Consistently to Total MOC Price Transactions

Regular closing price trades are likely to be part of trades on index rebalancing days

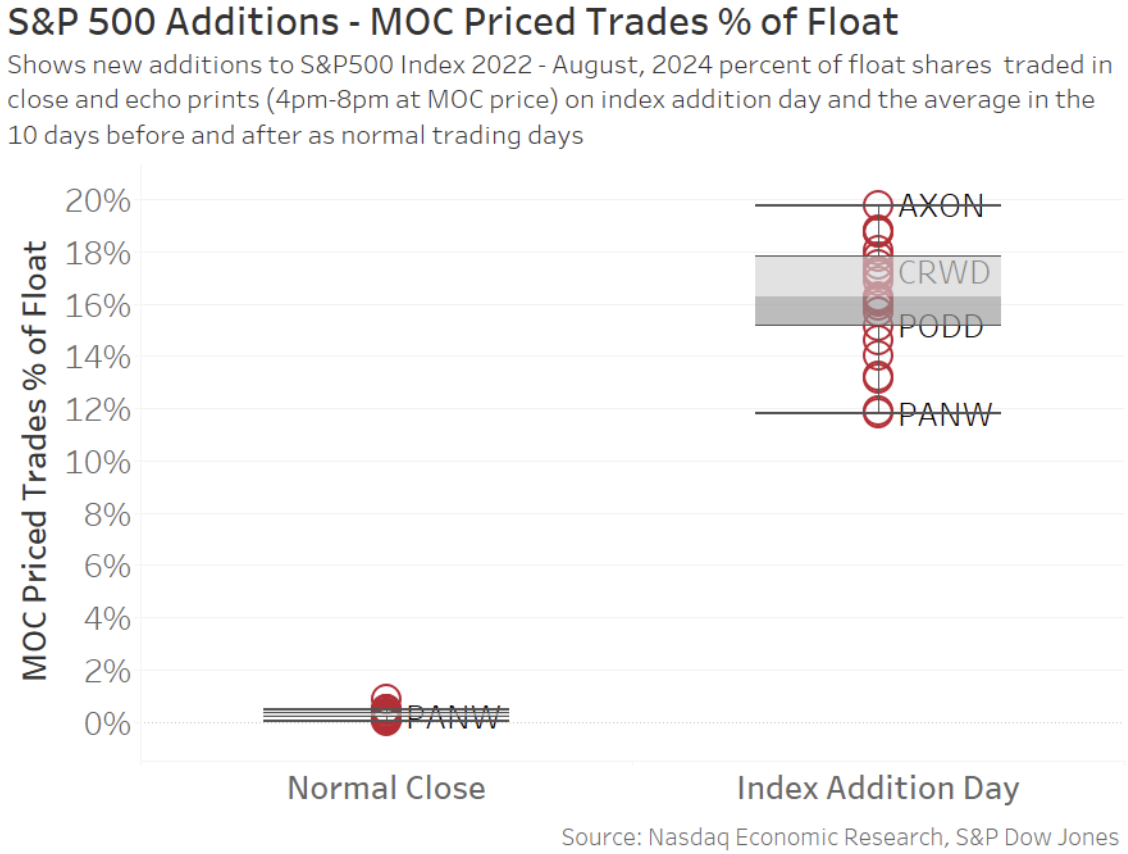

You may also be wondering whether you should remove “regular” or non-indexed MOC volumes from the above totals. Especially considering what I said earlier that MOC is usually more active (and has a lower index) than people think.

However, if you look at the trading volume at the “normal” closing price and compare it to the trading volume seen on the index addition date, you will see that the adjustment is a rounding error (as Exhibit 4 shows).

The reason index trades appear so large in this view is because the data in Chart 1 is whole Market – Index trading typically only affects the market; added Stocks – So the effect on the index of adding stocks is magnified (or concentrated).

This highlights how important index additions are for companies. As a result, a significant portion of the total float is purchased by index funds. Also, index funds are typically long-term holders.

Figure 4: “Normal” MOC activity is part of index trading on rebalancing day

The data in Figure 4 also shows the typical dispersion of the results averaged in Figure 2. While additions to the average S&P 500 add up to 16% of a company’s float, actual trades are typically in the 14% to 18% range, and sometimes much more. .

It’s also worth noting that most of S&P’s additions are made away from the quad witch. This is important because S&P results can be overstated if quadwitch trades are not performed.

S&P’s quarterly rebalancing typically includes “other” index changes such as free float, style, and outstanding stock updates. The S&P 500 has always been a “500 company” index, so additions are typically made when other companies leave the index (often through M&A). However, to be fair, the past few quarterly rebalances have included promotions and demotions to reallocate stocks to more appropriate market capitalization groups.

Adding an index is good for companies

We know that adding an index creates a lot of liquidity in the added stocks.

This study shows how much of the float changes stocks on those days and is likely to be purchased by index funds.

Importantly, index additions are almost always good for companies. Index funds are long-term, large new investor bases. Inclusion in the index may also increase interest from active mutual funds and increase access to U.S. funds for future investments.

Nicole Torskiy, Senior Economic Research Specialist, contributed to this article.