I discussed within the earlier publish When to Declare Social Safety: How A lot Does It Matter, Anyway? {that a} frequent suggestion for a married couple is for the lower-earning partner to assert Social Safety early at 62, and for the higher-earning partner to delay claiming till age 70. A number of readers raised a priority that claiming Social Safety at 62 could elevate the ACA medical health insurance premiums. The identical concern additionally applies to a single individual contemplating claiming at 62.

We’re assuming that you just’re not working whenever you’re contemplating claiming Social Safety at 62. In any other case, the Social Safety earnings check could apply, which defeats the aim of claiming at 62. Once you’re not eligible for Medicare but, you’ll more than likely purchase medical health insurance from the ACA market except you will have retiree medical health insurance otherwise you’re lined by means of your partner.

ACA Premium Subsidy, Cliff or Ramp?

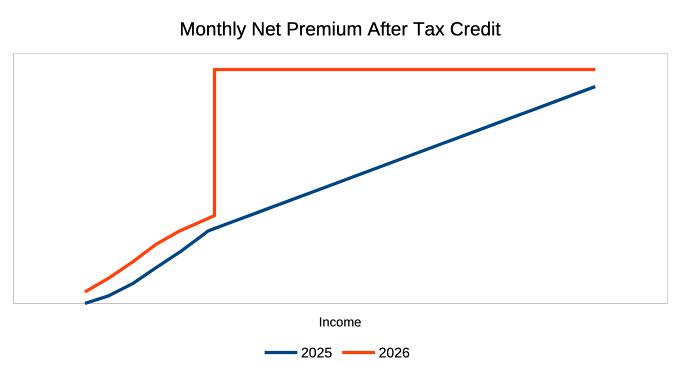

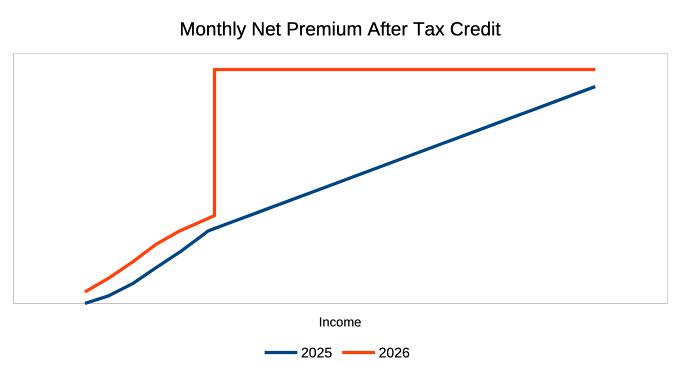

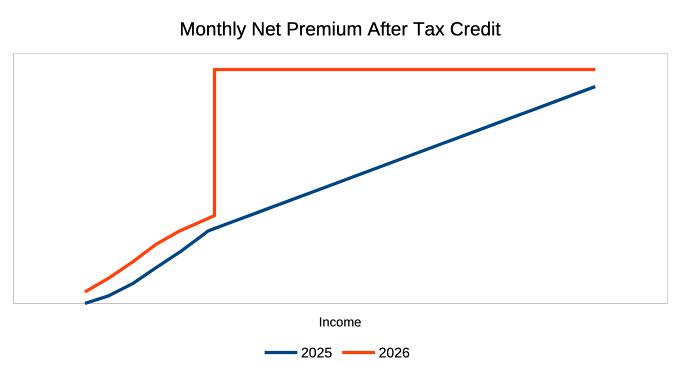

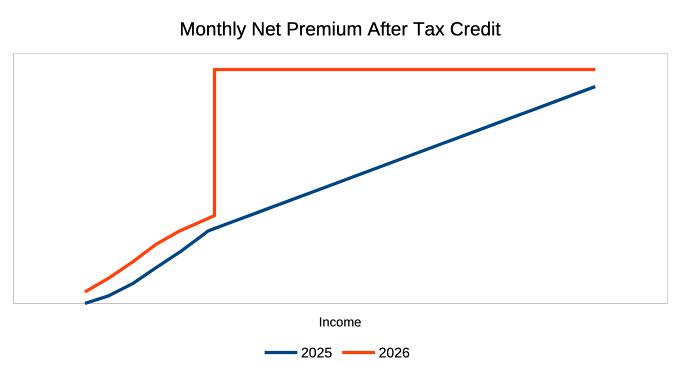

How does claiming Social Safety have an effect on the ACA medical health insurance premiums? It is determined by your family revenue. I had this chart in my publish The ACA Premium Subsidy Cliff After the 2025 Trump Tax Legislation:

The federal authorities is at the moment shut down resulting from disagreements in how ACA medical health insurance premiums will likely be structured in 2026 and past. The blue line within the chart represents the regulation in impact in 2025. As your family revenue will increase, your ACA medical health insurance premiums additionally improve on a ramp. The orange line represents what is going to occur in 2026 and past if Congress doesn’t move a brand new regulation to cease it. The ACA medical health insurance premiums will likely be increased in any respect revenue ranges, after which all of the sudden soar up a cliff when your family revenue exceeds 400% of the Federal Poverty Stage (FPL), which is $62,600 for a single-person family, and $84,600 for a two-person family, in 2026.

The primary query is whether or not there will likely be a cliff.

Suppose there’s a cliff (the orange line), and your family revenue is already over the cliff earlier than claiming Social Safety (the flat a part of the orange line). In that case, you’re already paying the total worth with none premium tax credit score. Receiving extra revenue from Social Safety will NOT have an effect on your ACA medical health insurance premiums.

Suppose there’s no cliff (the blue line), or suppose there’s a cliff, however your family revenue will nonetheless be under 400% of FPL after claiming Social Safety (the left a part of the orange line). In that case, every $100 of incremental revenue from Social Safety will improve your ACA medical health insurance premiums by $10 – $20.

If there’s a cliff (the orange line), and claiming Social Safety will push your family revenue from under the 400% of FPL cliff to above it, your ACA medical health insurance premiums will soar rather a lot. That’ll make it not price claiming Social Safety at 62.

| Family Earnings | Cliff | No Cliff |

|---|---|---|

| > 400% FPL earlier than SS | No Impact | Improve by 10% of the incremental revenue |

| < 400% FPL after SS | Improve by 10-20% of the incremental revenue | Improve by 15-20% of the incremental revenue |

| Cross 400% FPL with SS | Enormous Soar | Improve by 10-20% of the incremental revenue |

Changing or Growing Earnings?

Be aware that the desk above says “incremental revenue.” The incremental revenue isn’t essentially 100% of the Social Safety advantages you’ll obtain. The incremental revenue will be zero or unfavourable if receiving Social Safety will solely change different revenue.

The place does your family revenue come from earlier than claiming Social Safety?

Case 1. Suppose you’re withdrawing from a pre-tax account, comparable to a Conventional IRA, to cowl dwelling bills earlier than claiming Social Safety. A $20,000 withdrawal counts as $20,000 of revenue for ACA medical health insurance. You don’t must withdraw as a lot to cowl dwelling bills now after you declare Social Safety. $20,000 in Social Safety advantages additionally counts as $20,000 of revenue for ACA medical health insurance. Your revenue stays the identical whenever you change the identical quantity of withdrawals from a pre-tax account with Social Safety.

The IRS taxes at most 85% of Social Safety advantages, whereas many states don’t tax Social Safety. In distinction, pre-tax account withdrawals are absolutely taxable by the IRS and most states. Once you obtain $20,000 in Social Safety advantages, it might change perhaps $22,000 in pre-tax account withdrawals to cowl the identical quantity of dwelling bills.

Your incremental revenue will likely be unfavourable, and your ACA medical health insurance premiums will lower in the event you change a bigger quantity in pre-tax withdrawals with Social Safety advantages.

Case 2. Suppose you’re promoting appreciated investments in a taxable account to cowl dwelling bills earlier than claiming Social Safety. Solely the capital good points portion counts as revenue for ACA medical health insurance. Suppose your investments comprise 30% as price foundation and 70% as capital good points. $14,000 from promoting $20,000 price of investments counts as your revenue for ACA medical health insurance.

You don’t must promote a lot to cowl dwelling bills now after you declare Social Safety. $20,000 in Social Safety advantages counts as $20,000 in your revenue for ACA medical health insurance. Changing funding gross sales with Social Safety will improve your revenue for ACA medical health insurance, however by solely 30% of the Social Safety advantages on this instance.

Case 3. Suppose your present family revenue comes from a pension, rental revenue, curiosity and dividends, and different revenue that may’t be stopped after claiming Social Safety. On this case, 100% of the Social Safety advantages will likely be incremental revenue.

| Supply of Earnings Earlier than SS | Incremental Earnings |

|---|---|

| Pre-tax account withdrawals | Zero or unfavourable, after decreasing withdrawals |

| Promoting investments in a taxable account | Partial, after decreasing funding gross sales |

| Unstoppable revenue | Full |

How Many Years on ACA Well being Insurance coverage?

Claiming Social Safety at 62 versus claiming at 65 whenever you qualify for Medicare will doubtlessly have an effect on your ACA medical health insurance premiums for 3 years. When you’ve got a youthful partner who’s additionally on ACA medical health insurance, claiming early may have an effect on your ACA medical health insurance premiums till the youthful partner can be 65. The extra years you’ll use ACA medical health insurance, the extra affect there could also be from claiming Social Safety at 62.

Examine with Delaying Social Safety

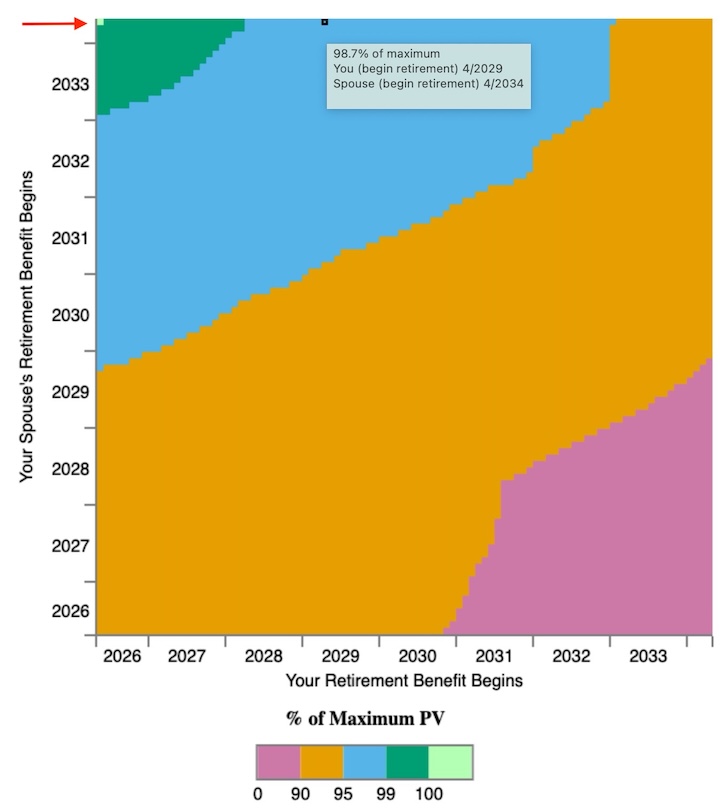

I ran a check case in Open Social Safety for a married couple, each born in 1964 (will likely be 62 in 2026). One partner has a Major Insurance coverage Quantity of $2,000 per 30 days, and the opposite has $3,000 per 30 days. The advice from Open Social Safety is for the lower-earning partner to assert at 62 and for the higher-earning partner to attend till 70.

If the lower-earning partner waits till 65, this couple would nonetheless obtain 98.7% of the utmost current worth from Social Safety. The distinction within the whole current worth is $9,470 over their lifetime. See extra on how one can use Open Social Safety in When to Declare Social Safety: How A lot Does It Matter, Anyway?

Suppose their incremental revenue from claiming Social Safety falls into the “partial” class, and the impact on their ACA medical health insurance premium isn’t a giant soar, however 10-20% of the incremental revenue. Then they should stability the rise in ACA medical health insurance premiums towards the loss within the current worth of Social Safety advantages if the lower-earning partner waits till age 65.

$2,000 per 30 days at Full Retirement Age interprets to $16,900 per 12 months when the advantages are claimed early at age 62. Suppose receiving $16,900 in Social Safety advantages brings 30% of the advantages as incremental revenue, and it will increase their ACA medical health insurance premiums by 15% of the incremental revenue. The rise within the ACA medical health insurance premiums for 3 years is:

$16,900 * 30% * 15% * 3 = $2,282

That’s a lot lower than the $9,470 loss in whole current worth from delaying claiming till age 65. The lower-earning partner ought to declare at 62 regardless of the rise in ACA medical health insurance premiums.

Then again, if 100% of the $16,900 in Social Safety advantages will likely be incremental revenue, and it’ll push their revenue over a cliff, which can improve their ACA medical health insurance premiums by $2,000 a month, then clearly they need to maintain off claiming Social Safety till they not use ACA medical health insurance.

It All Relies upon

Claiming Social Safety at 62 doesn’t essentially improve your revenue for ACA medical health insurance. In some instances, it might lower your revenue and decrease your premiums. If it does improve your revenue, the incremental revenue isn’t essentially 100% of the Social Safety advantages. It may be solely a small proportion of the advantages. The premium improve from the incremental revenue will be lower than the loss within the whole current worth of Social Safety advantages in the event you select to delay claiming till 65. Don’t be afraid to assert Social Safety at 62 solely as a result of it could elevate your ACA medical health insurance premiums.

In another instances, claiming Social Safety at 62 will improve your revenue by a big proportion of the advantages, which can push it over a cliff and lift your ACA medical health insurance premiums by an enormous quantity, probably greater than the Social Safety advantages obtained.

All of it is determined by whether or not there’s a cliff, and in that case, the place your family revenue is relative to the cliff earlier than and after claiming Social Safety. A ramp is far simpler to take care of than a cliff.

It is best to calculate your incremental revenue primarily based on the revenue composition earlier than claiming Social Safety. Wait to see how the cliff state of affairs will likely be resolved. Then calculate the impact in your ACA medical health insurance premiums, and evaluate with delaying claiming Social Safety.

Handle Danger

Lastly, legal guidelines can change, and your monetary state of affairs can change. In case you suppose it’s too dangerous and also you wish to keep away from any issues, it’s OK to delay claiming Social Safety till you not use ACA medical health insurance.

It comes all the way down to “What if I’m incorrect?” What in the event you suppose you’ll go over a cliff, however you don’t? You delay claiming and unnecessarily lose 1.3% of your Social Safety advantages in my instance. What in the event you suppose you’re safely below the cliff, and also you’re all of the sudden over? You pay an enormous quantity in ACA medical health insurance premiums. Dropping 1.3% of the lifetime Social Safety advantages could also be a small worth to pay for the peace of thoughts that your ACA medical health insurance premiums received’t blow up in your face. See Use Pascal’s Wager When You’re Not Positive About Tax Guidelines.

Be taught the Nuts and Bolts

I put every thing I take advantage of to handle my cash in a ebook. My Monetary Toolbox guides you to a transparent plan of action.