Key Takeaways

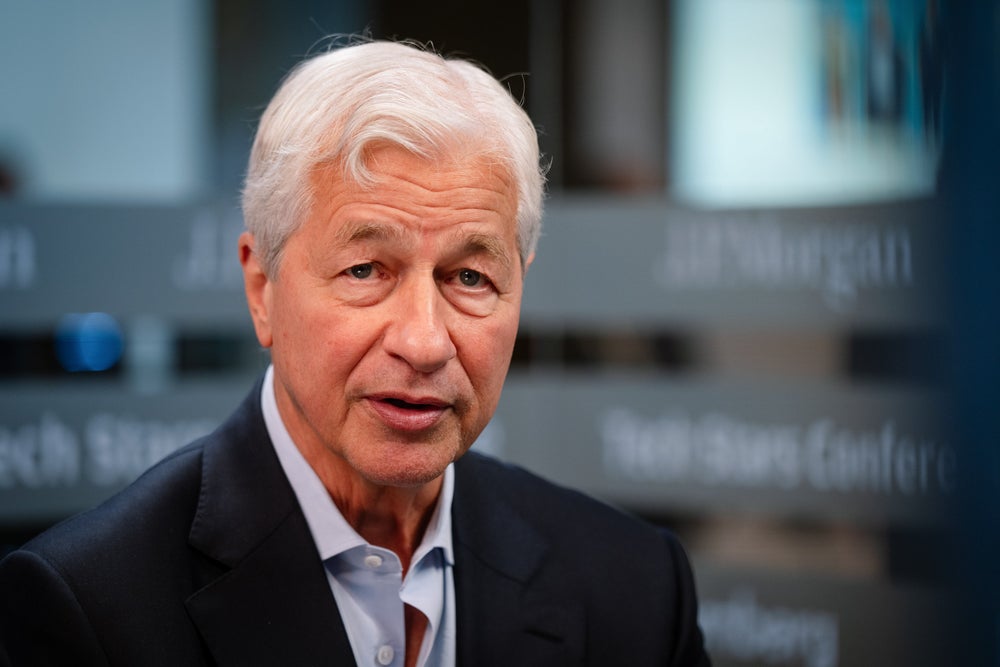

- Jamie Dimon is the CEO of JPMorgan Chase, the biggest financial institution within the U.S.

- In a brand new interview, Dimon mentioned that JPMorgan is saving billions on account of its funding in AI.

- AI has offered “about $2 billion of profit” to the financial institution, in accordance with Dimon.

JPMorgan Chase, the largest financial institution within the U.S. with $3.46 trillion in belongings, invests about $2 billion a 12 months into AI know-how. In accordance with CEO Jamie Dimon, that funding has already paid for itself.

Dimon advised Bloomberg TV on Tuesday that the financial institution has saved roughly “$2 billion” yearly from utilizing AI in every little thing from danger administration to customer support, and that AI is now serving to with operations in practically each a part of the financial institution, from advertising and marketing to thought era. About 150,000 staff per week use JPMorgan’s inside AI mannequin, educated on the financial institution’s information, to conduct analysis, summarize stories and scan contracts, he mentioned.

“We now have proven that for $2 billion of expense, we’ve about $2 billion of profit,” Dimon advised the outlet. “Some we are able to do in actual element: We did this, we decreased headcount, we saved this money and time. Some you may’t: It simply improved service.”

Dimon claimed that the $2 billion price of value financial savings was simply “the tip of the iceberg.” He mentioned the financial institution already has tons of of use instances for the know-how, together with fraud detection and danger administration, and that quantity is ready to develop. One use case is a money circulate intelligence AI software that reduce human-oriented handbook work by near 90% final 12 months.

Nevertheless, Dimon additionally cautioned that AI carries the potential to get rid of some jobs, including that the financial institution is targeted on “retraining” and “redeploying” staff.

“For JPMorgan, if we’re profitable, we’ll have extra jobs — however there’ll in all probability be [fewer] jobs in sure features,” he advised Bloomberg TV.

Dimon additionally talked about that JPMorgan has a protracted historical past with AI — the financial institution has been utilizing and creating the know-how since 2012. At present, it employs round 2,000 AI and machine studying consultants.

Associated: JPMorgan CEO Jamie Dimon Simply Made a Large Announcement About His Retirement Timeline: ‘I Love What I Do’

Dimon has beforehand weighed in on AI’s affect on humanity, predicting in October 2023 and a 12 months later that the following era will “reside to 100” and “be working three-and-a-half days per week” because of the know-how. He mentioned AI is the following wave of technological progress, just like the steam engine or the Web.

In the meantime, JPMorgan’s enterprise is performing nicely. The financial institution’s most up-to-date earnings report for the second quarter of the 12 months was “robust,” Dimon acknowledged in a July earnings press launch, reporting a internet earnings of $15 billion. The subsequent earnings report date for the financial institution is Oct. 14.

Associated: JPMorgan Chase CEO Jamie Dimon Shares 4 Suggestions for Leaders

Key Takeaways

- Jamie Dimon is the CEO of JPMorgan Chase, the biggest financial institution within the U.S.

- In a brand new interview, Dimon mentioned that JPMorgan is saving billions on account of its funding in AI.

- AI has offered “about $2 billion of profit” to the financial institution, in accordance with Dimon.

JPMorgan Chase, the largest financial institution within the U.S. with $3.46 trillion in belongings, invests about $2 billion a 12 months into AI know-how. In accordance with CEO Jamie Dimon, that funding has already paid for itself.

Dimon advised Bloomberg TV on Tuesday that the financial institution has saved roughly “$2 billion” yearly from utilizing AI in every little thing from danger administration to customer support, and that AI is now serving to with operations in practically each a part of the financial institution, from advertising and marketing to thought era. About 150,000 staff per week use JPMorgan’s inside AI mannequin, educated on the financial institution’s information, to conduct analysis, summarize stories and scan contracts, he mentioned.

“We now have proven that for $2 billion of expense, we’ve about $2 billion of profit,” Dimon advised the outlet. “Some we are able to do in actual element: We did this, we decreased headcount, we saved this money and time. Some you may’t: It simply improved service.”

The remainder of this text is locked.

Be a part of Entrepreneur+ at present for entry.