Again in 2020, I purchased a 5-year deferred fastened annuity, also referred to as a Multi-12 months Assured Annuity (MYGA). A MYGA, in essence, is sort of a CD issued by an insurance coverage firm. The insurance coverage firm ensures a set price for a set interval. I spoke about MYGAs in my April 2021 presentation, Fastened Revenue Alternate options in a Low-Yield Surroundings.

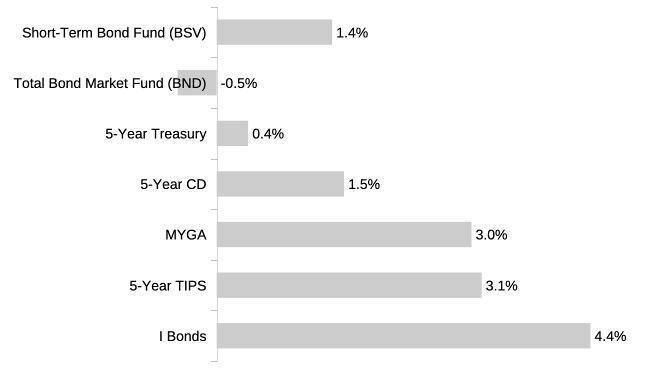

I purchased the 5-year MYGA as a result of it was paying considerably greater than a 5-year CD from a financial institution or credit score union at the moment. The MYGA paid 3% a yr. The very best 5-year CD was paying 1.5%. This MYGA had reached its 5-year assure interval final month. I ended it and pulled the cash again to my Constancy account.

The insurance coverage firm saved all its guarantees. Every part labored precisely as marketed. The MYGA was illiquid, with a prohibitive penalty in case you withdraw greater than 10% of the steadiness annually, however I knew that moving into. The insurance coverage firm was a bit of sluggish in processing paperwork, nevertheless it was nothing in comparison with the sluggish handbook processing at TreausryDirect, which may take from six weeks to 10 months.

By way of funding returns, the MYGA did higher in these 5 years than a short-term bond fund, a complete bond market fund, a 5-year Treasury, and the very best 5-year CD. It trailed a 5-year TIPS by solely a hair. I Bonds did higher, however they’d low buy limits.

Nevertheless, I might put my expertise with MYGA within the “profitable the battle however dropping the conflict” class. That’s why I’m not renewing it or shopping for one other MYGA.

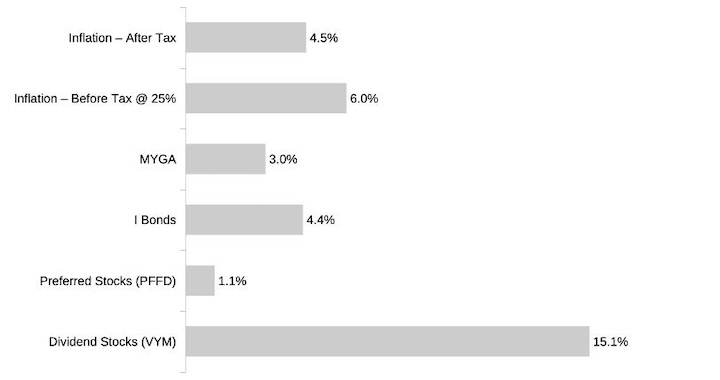

The conflict is towards inflation. Inflation averaged 4.5% a yr within the final 5 years. Since you pay taxes on the gross return, in case your tax price is 25%, you’d must earn 6% a yr to maintain tempo with inflation. Seen by way of this lens, all bond investments misplaced to inflation within the final 5 years. The Vanguard Complete Bond Market Index Fund had a unfavorable 5-year return earlier than inflation.

Bond Substitutes

Burton Malkiel is the creator of the well-known e-book A Random Stroll Down Wall Road. He was making rounds within the podcast circle in the summertime of 2020 to advertise the twelfth version of that e-book. Mr. Malkiel known as the low-interest-rate atmosphere at the moment “monetary repression.” He instructed decreasing the allocation to bonds and investing in most well-liked shares and high-dividend shares as “bond substitutes.”

Burton Malkiel’s suggestion for investing in “bond substitutes” was controversial at the moment. Some commentators went as far as to say it was silly. Now we see the outcomes after 5 years.

Most popular shares didn’t do properly, however high-dividend shares did. Investing 50:50 in most well-liked shares and high-dividend shares outpaced inflation each earlier than tax and after tax. Bond substitutes gained the conflict.

The Forest and The Timber

My tour to MYGA exhibits that we are inclined to pay extra consideration to issues that may be analyzed with larger certainty, whereas neglecting issues which can be extra unsure however have a extra vital affect. I usually see individuals asking questions alongside these strains:

Which cash market fund ought to I exploit?

Purchase I Bonds in April or Could?

Ought to I spend money on Constancy’s S&P 500 fund (FXAIX) or Vanguard’s S&P 500 ETF (VOO). What about Constancy’s Zero fund?

TIPS ladder or TIPS fund?

Every query is difficult in its personal method in case you take a look at it underneath a microscope. There’s a robust spreadsheet that sends you an e mail alert when it’s time to modify from one cash market fund to a different. These selections make a distinction, however they simply fall into the “profitable the battle however dropping the conflict” class. Earlier than diving into the very best place to park your money, think about whether or not you must park that a lot money within the first place. Then you’ll keep away from a dilemma like this:

Saved up 1 million for a home we’re not shopping for, now investing it into the market

The large-picture selections don’t have a simple reply, however they make a a lot bigger distinction once you get them proper.

How a lot to spend money on shares, bonds, money, actual property, Bitcoin, or gold?

U.S shares versus worldwide?

Worth shares or progress shares?

Developed worldwide international locations or rising markets?

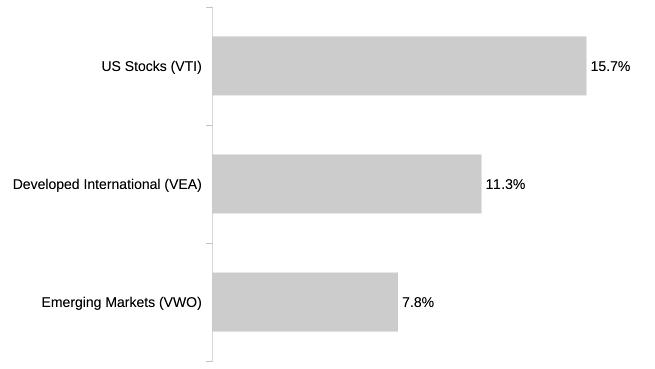

Burton Malkiel obtained the “bond substitutes” proper. Nevertheless, his different ideas in the identical podcast episode for growing allocation to worldwide shares and growing allocation to rising market shares inside worldwide shares didn’t pan out. His arguments sounded convincing, they usually nonetheless do at this time, however the markets simply didn’t settle for them.

U.S. shares outperformed worldwide shares, and developed market shares outperformed rising market shares, each by a considerable margin. How a lot you invested in US shares versus worldwide shares, and in developed worldwide international locations versus rising markets, made an enormous distinction within the final 5 years. This is the reason VTSAX-and-chill was a simple promote.

Possibly it would take extra time for these different ideas from Burton Malkiel to have the final snicker. Possibly they gained’t ever catch up. Both method, don’t lose sight of the forest once you study the bushes.

Be taught the Nuts and Bolts

I put every little thing I exploit to handle my cash in a e-book. My Monetary Toolbox guides you to a transparent plan of action.