Khosla Ventures-backed Fireflies.ai, an AI-powered note-taking app, on Wednesday released a set of domain-specific “mini apps” to extract insights from meeting transcripts automatically.

With the widespread availability of automatic speech recognition models and generative AI, meeting intelligence startups like Otter, Read AI, Circleback, Krisp, and Granola have registered impressive growth. Fireflies, similarly, has seen 8x expansion in terms of users and has achieved profitability, according to co-founder and CEO Krish Ramineni.

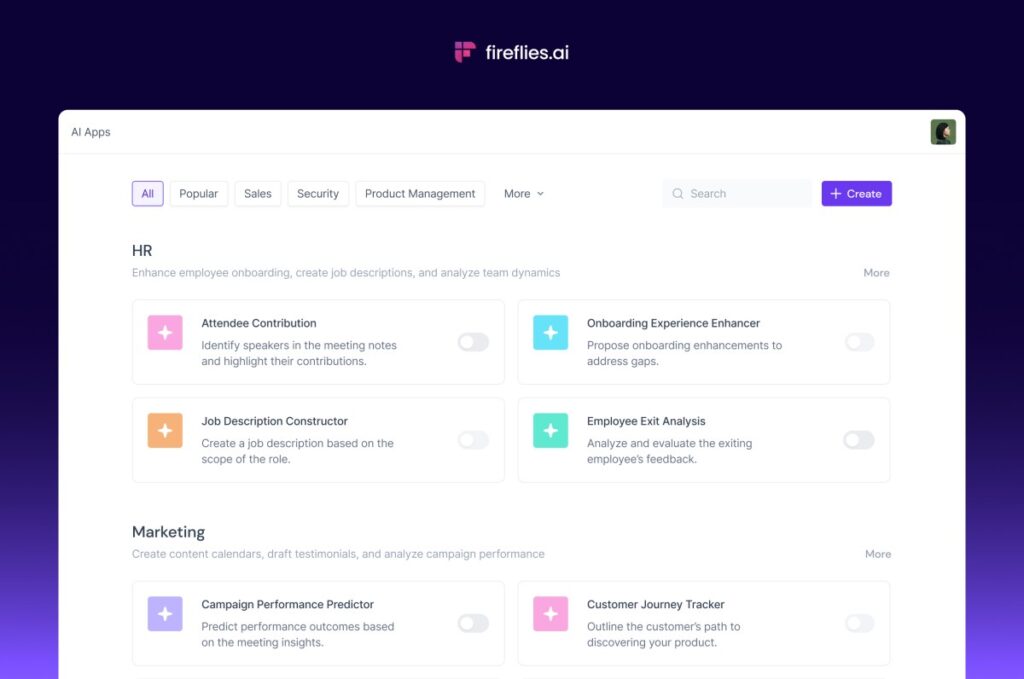

To boost growth further, the startup is releasing over 200 mini apps within its platform for different roles and use cases, including sales, marketing, recruiting, operations and management, customer support, and customer success.

There’s the BANT Sales App, for example, which will extract details like budget and timelines for sales teams. The Agent Performance Feedback Generator will generate insights for a customer service agent’s performance and give coaching tips. Elsewhere, the Product Launch Planning App will craft a product launch strategy.

If you have a transcription of a meeting, you could write a prompt to gather some insights using a tool like Circleback. But with its mini apps, Fireflies is looking to make the process easier by removing the need for prompting.

“The amount of time it takes to get insights from a conversation after a meeting is a lot,” Ramineni told TechCrunch. “We want to close that gap with these apps. With these apps, Fireflies can kick these actions off right after the meeting and make people more productive.”

Users can also choose to send output from these mini apps to other platforms through integrations with Salesforce, HubSpot, Asana, Jira, BambooHR, Greenhouse, Slack, and Microsoft Teams. For example, a meeting host can choose to share a meeting summary with a manager on Slack once the meeting is over.

Fireflies says that users can deploy these apps on a per-meeting basis and also create their own apps for more customized outputs. In the future, they will be able to share these apps within a user group, says the company.

Beyond mini apps, Fireflies is working to improve meeting knowledge by introducing a meeting brief to inform users about participants and organizations. Ramineni says that the company has also been testing a way to include “digital twins” of users in meetings that can respond to basic queries, similar to implementations apps like Zoom have tested.